Stock Markets in under 15 minutes. No ads. No politics. Easy to follow for your morning coffee, dog walk or commute.

Free Episode 12 min

Paid Episode 17 min

Scroll all the way down to the “Paid Subscriber’s Section” for charts

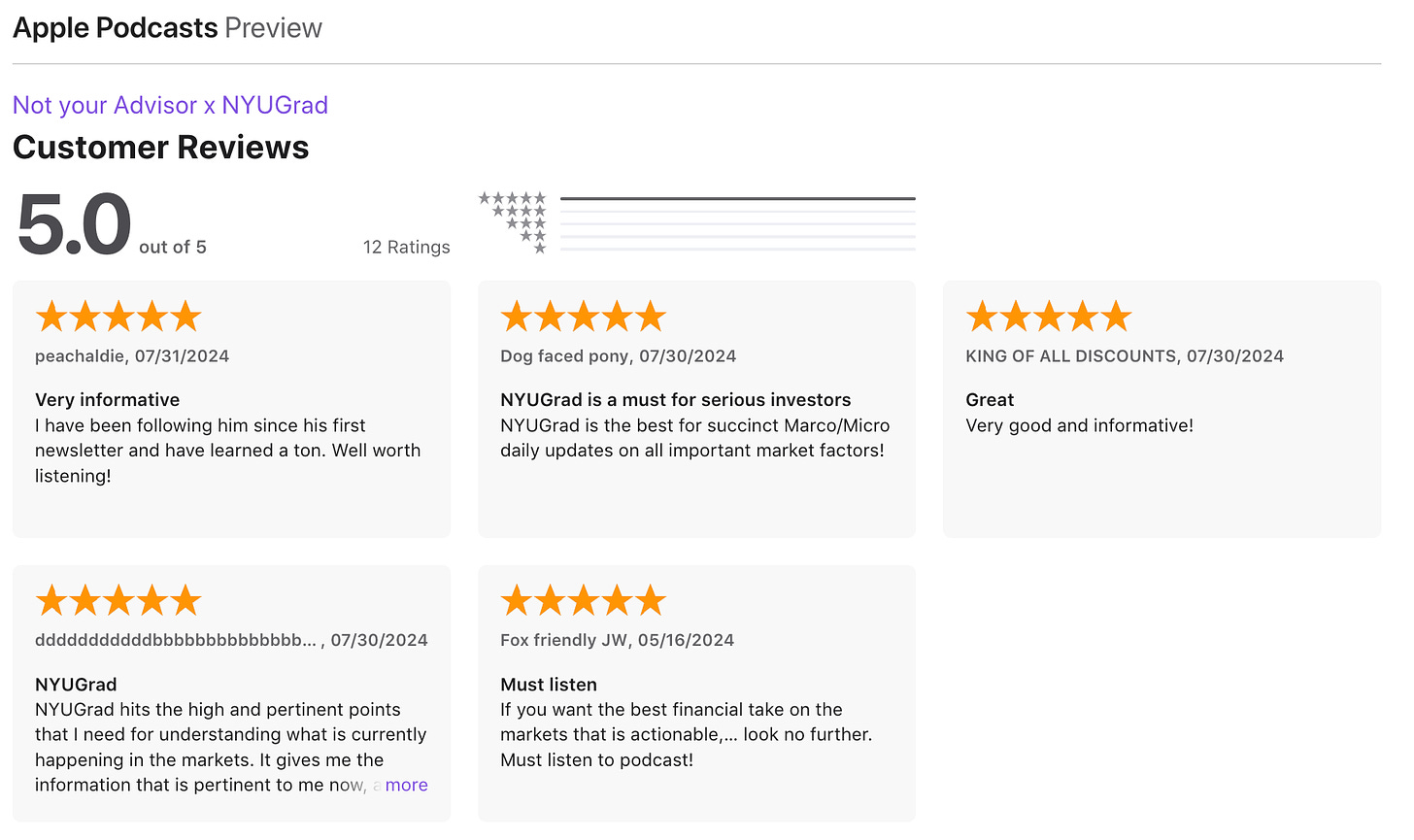

Link to Testimonials

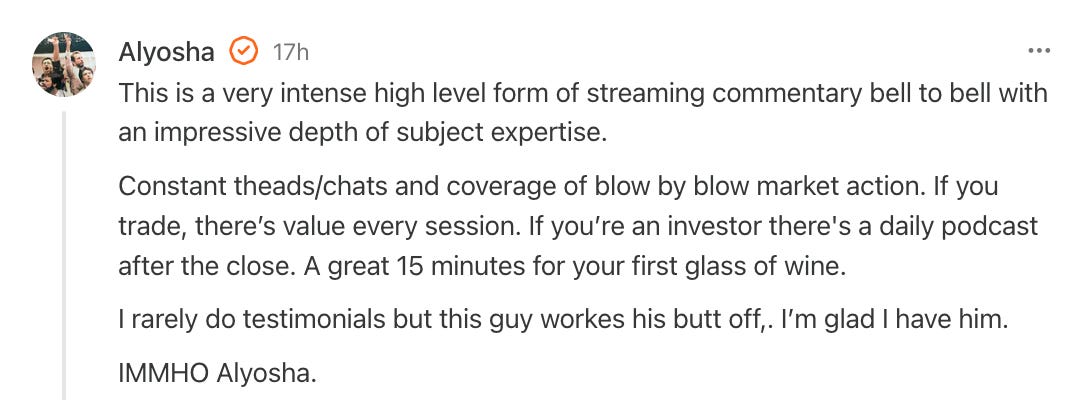

One Example:

“Thanks for consistent, quality content. It’s educational and has paid for itself several times over.

Even though I don’t actively trade, there’s so much usefulness in the daily podcast for navigating the bigger picture for my 401(k) and IRA. Often you touch on factors that will impact my clients at my day job, so it’s useful there too.

Finally, and perhaps most importantly, there’s a “Zen and the art of” quality to your world. it’s educational, elucidating, and exists at the intersection of theory and practice. Thoughtful and worthwhile!" - Will (Paying Subscriber)

Alyosha is a professional Comex trader and writes market vibes

Follow me on Substack Notes

Podcast Available on Spotify | Apple | Amazon

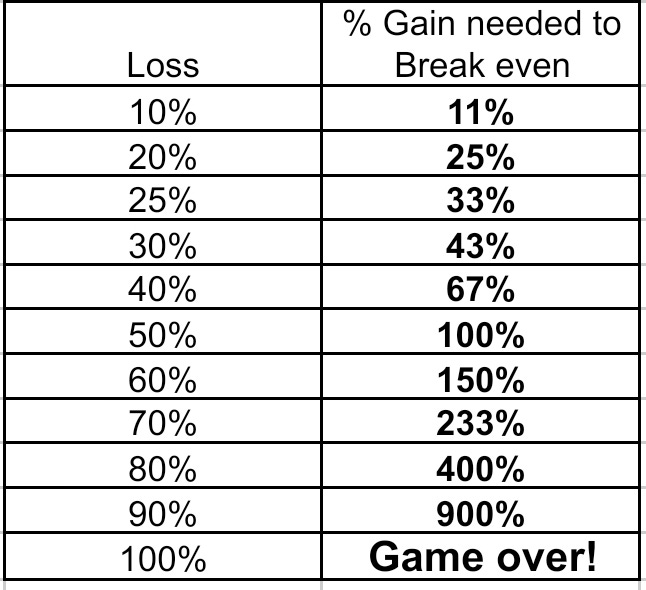

Save this spreadsheet or memorize it

Summary of the day

What are some of your favorite movies? I now it is hard to pick one so leave your favs in the comments.

A few of mine

Back to the Future

Sicario

Karate Kid 1

Kung Fu Panda

Top Gun

Predator

John Wick

Gladiator

Usual Suspects

The Big Short

I can go on, but that is a top of mind list

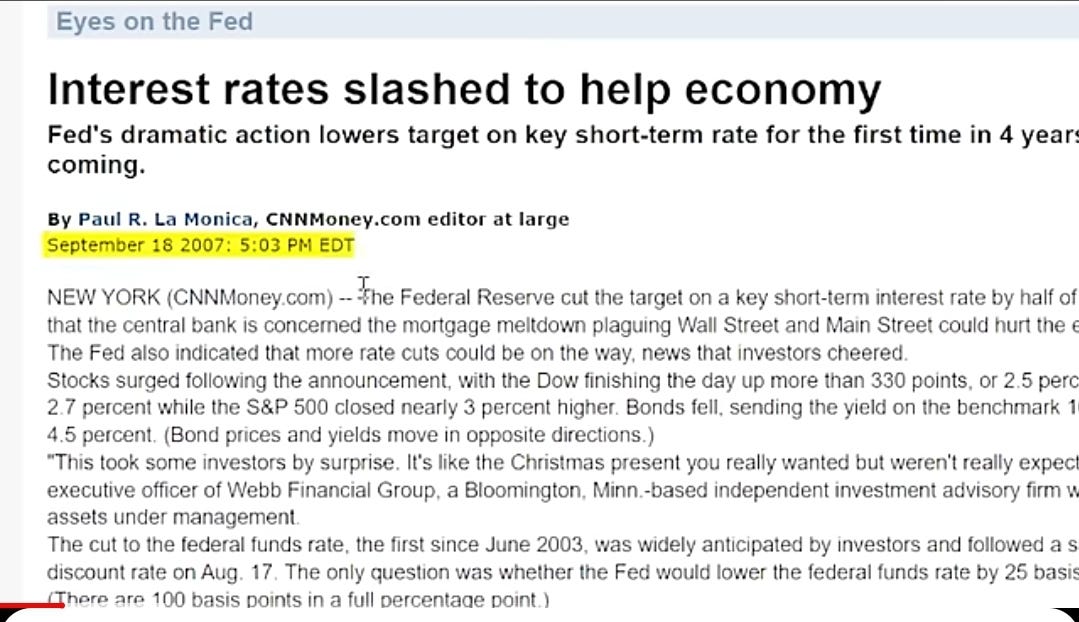

Yesterday I posted “There is nothing new on Wall St” and you can read it here:

But let’s cover it today.

September 18, 2007

NEW YORK (CNNMoney.com) -- The Federal Reserve cut the target on a key short-term interest rate by half of a percentage point Tuesday to 4.75% in a bold acknowledgement that the central bank is concerned the mortgage meltdown plaguing Wall Street and Main Street could hurt the economy.

The Fed also indicated that more rate cuts could be on the way, news that investors cheered.

The Dow Jones Industrial Average surged more than 200 points immediately following the news of the Fed's half-point rate cut and wound up finishing the day with a more than 335 point gain.

Stocks surged following the announcement, with the Dow finishing the day up more than 330 points, or 2.5 percent. The Nasdaq shot up 2.7 percent while the S&P 500 closed nearly 3 percent higher. Bonds fell, sending the yield on the benchmark 10-year U.S. Treasury up to 4.5 percent.

If my calculations are correct, lightning will strike the clock tower in Hill Valley on on October 11, 2024 at 10:04pm PST! (Saturday, November 12, 1955 for movie buffs)

Breadth

572 new highs

144 new lows

Nasdaq New Highs/Lows 76 Highs vs 69 Lows

31% advancing 65% declining

30% below 50 day ma

32% below the 200 day ma

Stuck out

We didn’t do much on the indices

Home builders all red

Strong

Weak

What to watch

Watch mag 7

Watch yields

Credit card delinquency rate (1991-Present)

True Rate of Unemployment (24%!!!)

Using data compiled by the federal government’s Bureau of Labor Statistics, the True Rate of Unemployment tracks the percentage of the U.S. labor force that does not have a full-time job (35+ hours a week) but wants one, has no job, or does not earn a living wage, conservatively pegged at $25,000 annually before taxes.

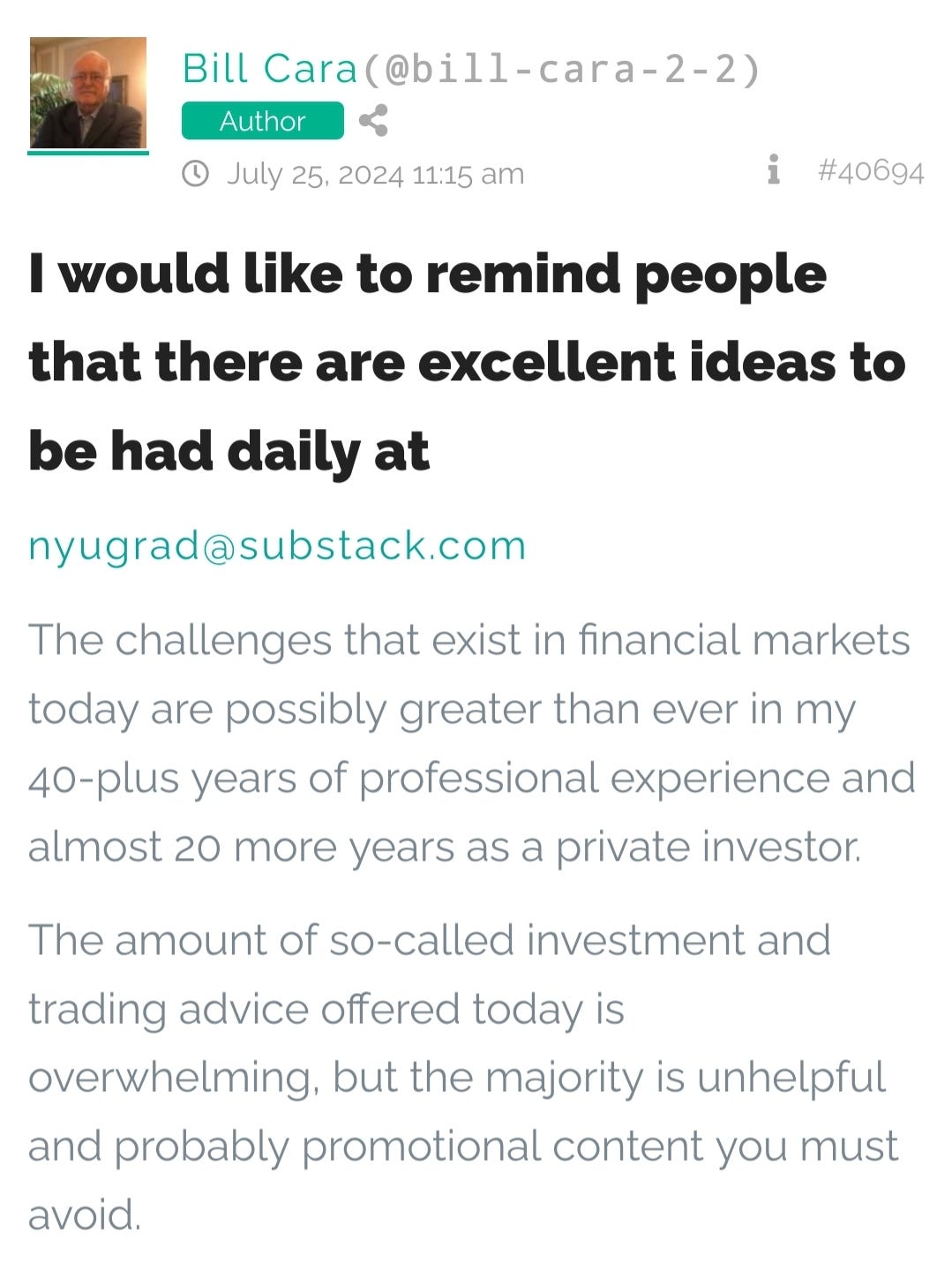

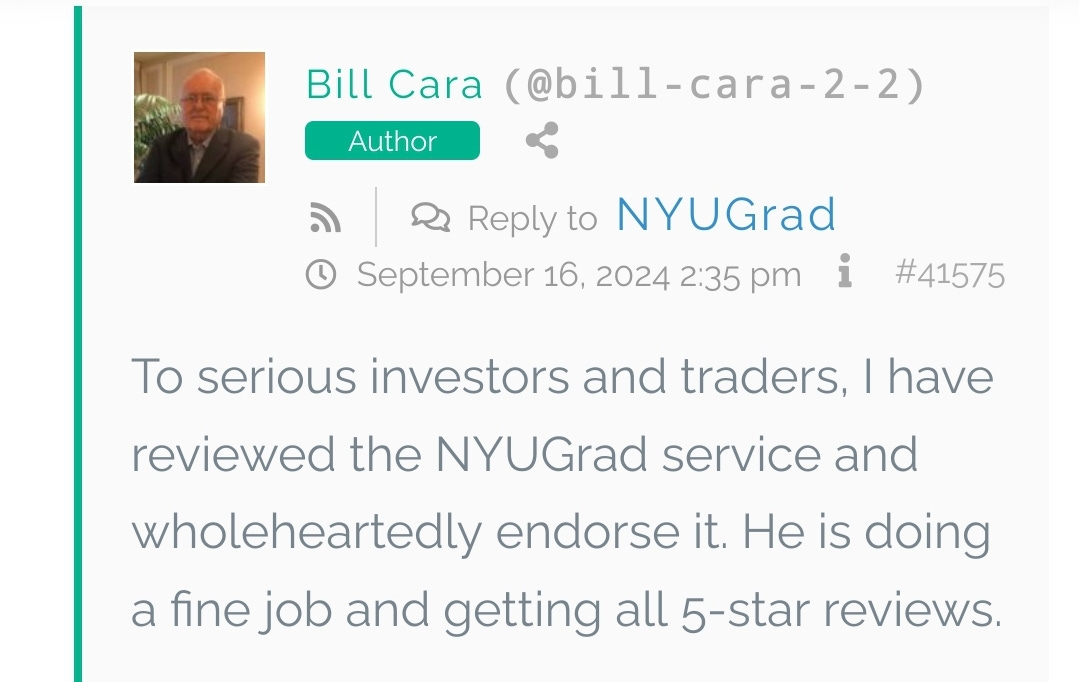

Whether you subscribe for free or paid, you will gain value and ability over time to see stock market price movement in a way Wall St does not want you to see.

At the very least, improve your own education so you can grade your financial advisors homework and performance!