This week will be the last free report.

Need your help with feedback. Global Market Navigator Week 6 below.

I. Survey link (Anonymous Google Form - No sign in required):

https://forms.gle/vUrEgMERJHpxE6vx6

-Foreword-

If you have been following my work, you already know I attribute a lot of my learning to Bill Cara and his work. He is relaunching an extensive Weekly report that covers the entirety of the market, and it is over 300 pages long with institutional level insight with a macro lens on the global machine that is the “Market”.

When Bill used to publish these weekly reports I initially understood a very small percentage of the report. I slowly began to chip away and tried to learn and much as I could week to week, researching the topics I did not understand. I then began to question him and do my own research on why Bill said certain things or why he was focusing on a particular piece of the jigsaw puzzle.

Here is the latest AI generated podcast that summarizes the full report. At over 300 pages this macro view of the global markets is institutional level content and is only available to premium subscribers moving forward. Eventually this will be a paid service at Billcara.com, and our audience here will get a discount.

Briefing Doc

Executive Summary:

These documents provide a broad overview of global financial markets, focusing on currencies, government bonds, Dow indices, and various international stock markets. They offer technical analysis insights using tools like RSI and MACD, and provide watchlists of stocks across different sectors and countries, along with relevant ETFs and indices for tracking performance. The reports also touch on economic factors influencing specific markets, such as Singapore's inflation and Japan's sophisticated capital markets.

Key Themes and Ideas:

Currency Market Coverage:

Extensive lists of currency pairs are provided, offering a comprehensive view of the foreign exchange market. Examples include: "$AUDSGD", "$AUDCHF AUD/CHF", "$AUDUSD AUD/USD", as well as numerous other currencies and their relationships to each other.

Government Bonds and Yields:

The documents track government bond yields for various countries, including the US, Germany, Japan, and the UK. They also provide insights into recent performance, for example: "The 10-year Japanese Treasury has soared +5.2% this week, +17.2% over 1 month, and +30.4% YTD. These are spectacular moves."

Focus is given to the US Treasury yields: "$UST2Y", "$UST3Y", "$UST5Y", "$UST7Y", "$UST10Y", "$UST20Y", "$UST30Y".

Includes links to Investing.com and StockCharts.com for further yield data.

US Dow Indexes and Dow Theory:

Highlights the importance of the Dow Jones Industrial Average (DJIA), Dow Jones Transports Average (DJTA), and Dow Jones Utilities Average (DJUA) as benchmarks for the US economy.

Mentions the relevance of Dow Theory: "Dow Theory has a legitimate foundation – the US economy- unlike cryptocurrency."

Lists the components of the DJIA, linking to Value Line studies: "AAPL - Apple, Inc. AMGN - Amgen, Inc. AMZN - Amazon.com..."

Technical Analysis Tools and Scoring System:

Emphasizes the use of technical indicators like RSI (Relative Strength Index) and MACD (Moving Average Convergence Divergence) for analyzing market trends.

Presents a scoring system for buy/sell signals based on moving averages and indicators: "Buy signal: +1", "Sell signal: -1", "Neutral signal: 0".

Explains how to interpret RSI signals (Overbought >70, Oversold <30).

Gold and Silver Miners:

Includes a watchlist of gold and silver mining stocks and ETFs: "Global X Silverminers ETF".

Provides background on key producers in the gold mining industry: "AEM - Agnico Eagle Mines Ltd. AG - First Majestic Silver Corp..."

Sector-Specific Stock Watchlists:

Offers watchlists for various sectors, including Industrials and Consumer Discretionary, along with performance updates. For example: "Goodyear Tire had a huge win on Friday, up +17.3% and +14.1% on the week."

Identifies bellwether stocks in each sector, like "WM - Waste Management, Inc" for Industrials and "MAT - Mattel, Inc" for Consumer Discretionary.

International Stock Markets:

Provides information on investing in various countries, including India, Japan, Singapore, Netherlands, and Sweden.

Details key indices and ETFs for each country: "Nifty 50 Index – India $NIFTY", "Netherlands Amsterdam Exchange Index (EOD) $AEX", "Dow Jones Sweden Stock Index (EOD) $SEDOW".

Lists prominent companies trading in these markets, both domestically and in the US (ADRs). For example, Japanese companies such as "Toyota 7203.T TM Keyence 6861.T KYCCF Sony 6758.T SONY"

Central Bank Digital Currencies (CBDCs):

Highlights the global trend towards regulated digital currencies, with different countries taking varied approaches:

India: "Intends to ban private cryptocurrencies while aggressively promoting its CBDC."

US: "Fed Chair Jerome Powell has explicitly ruled out a US CBDC."

China: "Continues to expand its digital yuan pilot."

Europe: "The European Central Bank is advancing with the digital euro."

Economic Factors and Market Influences:

Discusses economic factors influencing specific markets. For instance, "Singapore's inflation is cooling, signaling potential monetary easing and a shift in economic strategy."

Acknowledges risks from global economic uncertainties and potential trade policies. "However, because the economy relies on international shipping through its port, it faces potential risks from Trump 2.0 trade policies and global economic uncertainties."

Specific Data Points:

Treasury Yield Changes: Notes the modest increase of 0.10 bps in 1-month treasury yields and a more significant increase of 0.65 bps in 3-month yields.

German Stocks: Provides lists of German companies trading both domestically and in the US, as well as actively traded German bonds and commodity ETFs.

Hong Kong Market: Points out the recent surge in the Hong Kong domestic market, with stocks like Alibaba, China Telecom, and SMIC experiencing significant gains. "Alibaba, China Telecom, and SMIC are up +11.6%, +14.3%, and +19.0% this week. Over one month, these three stocks are up +63.4%, +38.0%, and +70.4%."

Cautions/Key Takeaways:

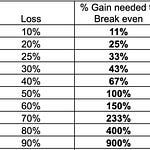

Technical Analysis is not foolproof: Emphasize that technical indicators should be used in conjunction with fundamental analysis and risk management strategies.

Global Market Interconnectedness: Recognizes the influence of global events and policies on individual markets.

Importance of Diverse Information: Stresses the need to look for trends and cycles, rather than relying on isolated data points: "Capital market prices move forward in trends and cycles. A snapshot is a piece of insufficient information to make trading decisions."

Impact of Leadership: Highlights the importance of the individuals running companies and countries. "The quality of a person who runs a company (or a country) matters to investors."

This briefing document provides a structured overview of the information contained in the sources, highlighting key themes, data points, and analytical tools. It should be a valuable resource for understanding the current state of global financial markets and making informed investment decisions.

Study Guide

I. Quiz

Answer the following questions in 2-3 sentences each.

What are the three Dow Jones Averages and what aspect of the US economy does each represent?

Explain the Dow Theory and why it's considered to have a legitimate foundation compared to cryptocurrency.

What does the RSI measure and how can it be used to identify potential buy or sell signals?

What is the MACD, and what type of trading signal does it generate?

How can an investor use Value Line studies to understand the Dow 30 companies?

Why is the port of Singapore important to its economy, and what potential risks does it face?

What are CBDCs and which countries or regions are actively pursuing them?

What are American Depositary Receipts (ADRs), and why are they useful for investors?

Identify at least three sectors and associated bellwether stocks that might be found in a Consumer Discretionary Stocks Watchlist.

Name three indices related to investing in India.

II. Quiz Answer Key

The Dow Jones Industrial Average (DJIA) represents industry, the Dow Jones Transportation Average (DJTA) represents commerce, and the Dow Jones Utility Average (DJUA) represents the utility sector. Together, they provide a broad benchmark of the US economy.

Dow Theory suggests that the US economy is driven by its industry, commerce, and finance. It is seen as legitimate because it is tied to real economic activity, unlike cryptocurrency, which lacks a tangible foundation.

The RSI (Relative Strength Index) measures the momentum of a stock, index, or other investment vehicle's price. An RSI above 70 suggests an overbought condition and a potential sell signal, while an RSI below 30 suggests an oversold condition and a potential buy signal.

MACD (Moving Average Convergence Divergence) is a trend-following momentum indicator that shows the relationship between two moving averages of prices. It can generate buy signals when the MACD line crosses above the signal line and sell signals when it crosses below.

Value Line studies provide in-depth information about each Dow 30 company stock, helping investors understand their financials, business operations, and future prospects, and are useful for traders and investors looking for potential support levels for these stocks.

The port of Singapore is a key component of its economy because the economy relies on international shipping through its port. The country may be impacted by shifts in global trade policies.

CBDCs (Central Bank Digital Currencies) are digital forms of a country's fiat currency, issued and regulated by the central bank. China, Europe, and India are actively pursuing the implementation of CBDCs, with varying approaches and progress.

American Depositary Receipts (ADRs) represent shares of foreign companies that trade on U.S. stock exchanges. They allow U.S. investors to invest in international companies without the complexities of cross-border transactions, allowing arbitrage trading on the same equity across markets.

Consumer Discretionary sectors might include Retail (Amazon.com), Restaurants (McDonald’s), and Home Improvement (Home Depot). These bellwether stocks serve as indicators of the overall health of the consumer discretionary sector.

The Nifty 50, Nifty Bank Index, and Nifty IT Index are all indices related to investing in the Indian stock market. These indices track the performance of the top 50 companies, banking sector, and IT sector, respectively, in India.

III. Essay Questions

Consider the following essay prompts, drawing on information from the provided sources.

Discuss the role of technical indicators such as RSI and MACD in making investment decisions. What are the limitations of relying solely on these indicators?

Compare and contrast the approaches taken by different countries and regions (e.g., China, the US, Europe) toward Central Bank Digital Currencies (CBDCs). What are the potential implications of these different strategies for the global financial system?

Evaluate the significance of the Dow Theory in today's economic environment. Is it still a relevant tool for understanding market trends, or has its importance diminished?

Analyze the factors that make Japan an attractive destination for foreign investment. What are the potential risks and challenges associated with investing in Japanese stocks?

Choose three international countries, excluding those listed above, and explain their unique economic characteristics and investment opportunities.

IV. Glossary of Key Terms

ADR (American Depositary Receipt): A certificate representing ownership of shares in a foreign company that trades on U.S. stock exchanges.

Averages (Dow Jones): Used to gauge the health of the economy.

CBDC (Central Bank Digital Currency): A digital form of a country's fiat currency, issued and regulated by the central bank.

DJIA (Dow Jones Industrial Average): A stock market index that tracks 30 large, publicly-owned companies trading on the New York Stock Exchange (NYSE) and the NASDAQ.

DJTA (Dow Jones Transportation Average): A stock market index that tracks 20 companies in the transportation sector.

DJUA (Dow Jones Utility Average): A stock market index that tracks 15 utility companies.

Dow Theory: A stock market theory that suggests that the US economy is driven by its industry, commerce, and finance and the general market trend is tied to real economic activity.

ETF (Exchange Traded Fund): A type of investment fund that holds a collection of assets, such as stocks or bonds, and trades on a stock exchange.

Eurodollar Index: An index that tracks the value of U.S. dollars held in foreign banks, primarily in Europe.

MACD (Moving Average Convergence Divergence): A trend-following momentum indicator that shows the relationship between two moving averages of prices.

NBD (New Best Data): This is a trading data source.

RSI (Relative Strength Index): A momentum indicator used in technical analysis that measures the magnitude of recent price changes to evaluate overbought or oversold conditions in the price of a stock or other asset.

Value Line: A research and investment analysis firm that provides in-depth information about companies and industries.

NotebookLM can be inaccurate; please double check its responses.