-Foreword-

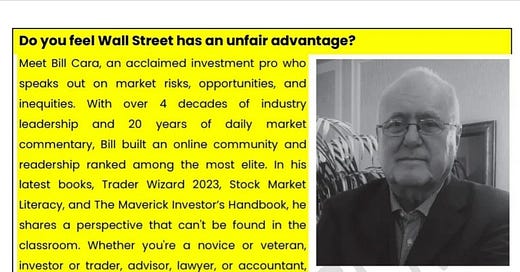

If you have been following my work, you already know I attribute a lot of my learning to Bill Cara and his work. He is relaunching an extensive Weekly report that covers the entirety of the market, and it is over 300 pages long with institutional level insight with a macro lens on the global machine that is the “Market”.

When Bill used to publish these weekly reports I initially understood a very small percentage of the report. I slowly began to chip away and tried to learn and much as I could week to week, researching the topics I did not understand. I then began to question him and do my own research on why Bill said certain things or why he was focusing on a particular piece of the jigsaw puzzle.

Here is the latest AI generated podcast that summarizes the full report. At over 300 pages this macro view of the global markets is institutional level content and is only available to premium subscribers moving forward. Eventually this will be a paid service at Billcara.com, and our audience here will get a discount.

Another free week

Briefing Doc

Date: October 26, 2023 (based on the document's internal dating of March 2025 references being future) Prepared For: Investment Analysis Team Prepared By: Gemini AI Subject: Review of Main Themes and Important Ideas from Navigator Reports 8 & 9

This briefing document summarizes the key themes, important ideas, and facts presented in the provided excerpts from "Navigator Report 8.pdf" and "Navigator Report 9.pdf." The reports offer insights into global investment landscapes, focusing on specific countries and regions, geopolitical developments impacting markets, and technical analysis of various asset classes.

I. Geopolitical and Economic Developments:

Trump's Tariffs and Global Sell-off: Both reports highlight the immediate market impact of renewed tariffs imposed by then-President Trump. The tariffs on Canada, Mexico, and China triggered a "global sell-off" (Navigator Report 8). This event underscores the sensitivity of global markets to trade policy changes and the potential for retaliatory measures from affected nations, such as Canada's hinted counter-tariffs and China's February response (Navigator Report 8).

India's Economic Momentum: Both reports emphasize India's strong economic performance. Navigator Report 8 notes "India’s IPO Surge" driven by NSDL’s large IPO and focuses on banking stocks like SBI and HDFC Bank. It also mentions the RBI's steady repo rate and a 7% GDP growth forecast bolstering the rupee. Navigator Report 9 reiterates this with reported Q4 2024 GDP growth of "7.5%, surpassing the government’s 7.0% estimate, driven by consumer spending and investment" (Navigator Report 9, quoting Economic Times India GDP). The IPO momentum is also mentioned again.

European Central Bank (ECB) Rate Cut Expectations: Navigator Report 8 mentions that "Germany’s 10-year Bund yield fell to 2.1% (from 2.3% mid-February, per Reuters), tracking US Treasuries amid expectations of an ECB rate cut (March 6 meeting looms)." This indicates a market anticipation of monetary easing in the Eurozone.

China's Stimulus Hopes: The reports note that "China’s 10-year yield dipped to 2.0% ahead of the National People’s Congress (NPC) starting March 5, signaling hopes for stimulus (Bloomberg)" (Navigator Report 8). This suggests market participants were expecting potential economic support measures from the Chinese government.

Bank of Japan's Hawkish Signals: Navigator Report 9 states regarding the Bank of Japan's March 7 stance: "No rate change, but hawkish comments suggest potential hikes later, per Reuters BoJ Update." This is a shift in tone that could influence the Yen and Japanese markets.

Middle East Oil Price Volatility: Navigator Report 8 points to "Saudi Arabia’s March price hike for Asia" and the ongoing "OPEC+ talks (March 5) and Iran-Israel tensions" as factors keeping oil price volatility alive.

II. Government Bonds and Yields:

Risk-Off Market and Declining US Treasury Yields: Navigator Report 8 notes that "The 10-year US Treasury Yield is dropping in a risk-off market condition where investors chase haven assets like government bonds." This highlights the inverse relationship between risk sentiment and demand for safe-haven assets.

Global Bond Yields Mirroring US Treasuries: The reports indicate that "Global government bond yields mirrored US Treasury movements to varying degrees" (Navigator Report 8). However, specific regional dynamics are also noted, such as the anticipation of ECB rate cuts affecting German Bund yields.

Significant Moves in Japanese Treasury Yields: Navigator Report 8 highlights "spectacular moves" in the 10-year Japanese Treasury yield with substantial weekly, monthly, and year-to-date increases. This contrasts with the relatively flat yield mentioned elsewhere and the later hawkish comments from the BoJ, suggesting potential shifts in Japan's monetary policy expectations.

Stagnation in Japan and Tariff Headwinds: A "0.9% JGB yield suggests stagnation, challenging exporters like Toyota amid tariff headwinds" (Navigator Report 8). This connects low bond yields to potential economic challenges for export-oriented companies.

III. Equity Markets and Indices:

Focus on Major Global Indices: Both reports dedicate significant sections to the Dow Jones Industrial Average (DJIA), Dow Jones Transportation Average (DJTA), and Dow Jones Utilities Average (DJUA), emphasizing their role as "leading benchmark[s] of the economy in the broadest terms" (Navigator Report 8 & 9). The reports also include technical analysis commentary, such as concerns about the Dow 30 potentially breaking down after the S&P 500 and NASDAQ.

Intra-Market Analysis: Navigator Report 8 emphasizes that "Intra-market analysis is a powerful research and decision-support tool."

Listing of Index Components: The reports provide detailed lists of the component companies within the Dow Jones Industrial Average and the Dow Jones Transportation Average.

Coverage of International Equity Markets: Both reports contain extensive lists of companies, domestic tickers, and corresponding US tickers (ADRs where applicable) for numerous countries across Europe (France, Germany, Italy, Spain, Netherlands, Nordic Countries), Asia (India, Australia/New Zealand, Japan, Singapore, Hong Kong, China), South America, and the Emerging World. They also list relevant ETFs for these regions, both domestic and those trading in the US.

Technical Outlook and Performance of Sectors: The reports include watchlist trading performance and technical outlook summaries for sectors like Gold Miners and Industrials, incorporating technical indicators like RSI and MACD. The Consumer Discretionary sector is also covered in Navigator Report 9, noting "Some ugly prices this week. Tariffs are a tax on consumers."

IV. Technical Analysis and Trading Tools:

Emphasis on Technical Indicators: The reports frequently reference and utilize technical indicators such as RSI (Relative Strength Index) and MACD (Moving Average Convergence Divergence) for analyzing market momentum and potential buy/sell signals.

Point & Figure Charts: Navigator Report 8 includes a "Dow 30 Point & Figure Chart ($INDU PnF)" and discusses potential chart patterns.

Scoring System for Technical Signals: The reports outline a scoring system for technical indicators, assigning +1 for a buy signal, -1 for a sell signal, and 0 for neutral, culminating in an "Overall Rating" from "Strong Buy" to "Strong Sell."

Importance of Trend and Cycle Analysis: Navigator Report 8 advises that "Capital market prices move forward in trends and cycles. A snapshot is a piece of insufficient information to make trading decisions. Look for trend and cycle reversals, as evidenced in weekly, daily, or hourly charts."

V. Investment Strategies and Considerations:

International Diversification: The extensive coverage of various international markets strongly suggests an emphasis on the importance of international diversification in investment portfolios.

Monitoring Currency Exchange Rates: The detailed lists of currency pairs (e.g., GBP/NZD, CAD/JPY) indicate the need to monitor exchange rate fluctuations when investing internationally.

Understanding ADRs: The reports explain that "some foreign issuers have stock that trades in American Depositary Receipt (ADR) form and some in the same security" and highlight that "Unsponsored ADRs trade OTC in the US." This is crucial for investors accessing international equities through US markets.

Consideration of Sector-Specific Dynamics: The inclusion of sector-based analyses (e.g., Industrials, Consumer Discretionary, Gold Miners) underscores the importance of understanding sector-specific factors influencing investment performance.

Impact of Geopolitical Events: The immediate market reactions to Trump's tariffs demonstrate the necessity of considering geopolitical developments and their potential impact on investment decisions.

Dividend and Buyback Potential: Regarding Industrial stocks, Navigator Report 9 notes that "Established industrial giants often provide steady dividends and repurchase shares during strong cycles."

VI. Data Sources and Links:

The reports consistently provide links to external financial websites such as LiveMint, SmartNews, Reuters, Bloomberg, Financial Times (FT), Investing.com, StockCharts.com, MarketBeat.com, and Yahoo Finance. These links serve as resources for accessing real-time data, charts, news, and company information.

Conclusion:

The excerpts from Navigator Reports 8 and 9 provide a snapshot of global financial markets, emphasizing the interplay of geopolitical events, macroeconomic factors, and technical analysis. Key themes include the impact of US trade policy, the strong growth narrative in India, evolving monetary policy expectations in major economies, and the importance of monitoring various asset classes and international markets. The reports offer a blend of top-down macroeconomic perspectives and bottom-up security-level information, supported by technical analysis tools and references to relevant data sources. The inclusion of extensive lists of international stocks and ETFs underscores a focus on global investment opportunities.

Study Guide

Quiz

What was the impact of Trump's reaffirmed tariffs on Canada, Mexico, and China, and what were some potential weekend reactions from trade partners?

Explain the significance of the Dow Jones Industrial Average (DJIA), the Dow Jones Transportation Average (DJTA), and the Dow Jones Utilities Average (DJUA) in assessing the U.S. economy.

Describe the recent performance of Japan's 10-year Treasury yield and discuss a potential challenge this might pose for Japanese exporters like Toyota.

What were the key factors driving India's GDP growth in Q4 2024, and what is the current repo rate set by the Reserve Bank of India (RBI)?

Define the Relative Strength Index (RSI) and explain how readings above 70 and below 30 are typically interpreted by investors.

Identify three components of the Dow Jones Industrial Average (DJIA) and name two companies included in the Dow Jones Transportation Average (DJTA).

What is an American Depositary Receipt (ADR), and why might investors or companies utilize this financial instrument when dealing with international stocks?

Based on the provided text, what were the movements in the German 10-year Bund yield and the UK gilt yield, and what economic factor influenced the German movement?

Name two major industries in Japan, and identify two of its significant international trading partners mentioned in the text.

What does a 0.9% yield on the Japanese 10-year Treasury suggest about the Japanese economy, and how might this relate to tariff headwinds?

Answer Key

Trump's reaffirmation of tariffs on Canada/Mexico (25%) and China (20%) sparked a global sell-off on Friday. Potential weekend reactions included Canada hinting at counter-tariffs and China's previous response of $21 billion in February, which could influence equities and commodities on Monday.

The DJIA, comprising 30 large US companies, is a key benchmark of the broad US economy. The DJTA, consisting of 20 major US transport firms, indicates the movement of goods and thus the economy's condition. The DJUA, made up of 15 significant utility companies, reflects the power supply vital for economic activity.

The 10-year Japanese Treasury yield has shown "spectacular moves," with a +5.2% increase in the past week, +17.2% over one month, and +30.4% year-to-date. A low yield like 0.9% suggests economic stagnation, which could challenge exporters like Toyota, especially when facing tariff headwinds.

India's Q4 2024 GDP growth of 7.5% was driven by increased consumer spending and investment, surpassing the government's 7.0% estimate. The Reserve Bank of India's (RBI) steady repo rate is 6.5%.

The Relative Strength Index (RSI) measures the speed and change of price movements over a specific period. An RSI reading above 70 typically signals an overbought condition, suggesting a potential sell-off, while a reading below 30 indicates an oversold condition, hinting at a potential buying opportunity.

Three components of the DJIA mentioned are Apple (AAPL), Boeing (BA), and Caterpillar (CAT). Two companies included in the DJTA are Alaska Air Group (ALK) and American Airlines Group (AAL).

An American Depositary Receipt (ADR) is a certificate representing shares of a foreign company's stock that are traded on U.S. stock exchanges. ADRs allow U.S. investors to more easily invest in foreign companies and provide foreign companies with access to U.S. capital markets.

Germany's 10-year Bund yield fell to 2.1% (from 2.3% in mid-February), tracking US Treasuries amid expectations of a European Central Bank (ECB) rate cut. UK gilt yields held steady at 4.0%, despite lingering fiscal concerns.

Two major industries in Japan are the production of motor vehicles and electronic equipment. Two significant international trading partners of Japan mentioned are the United States and China.

A 0.9% yield on the Japanese 10-year Treasury suggests economic stagnation. This low yield, combined with potential tariff increases, could create significant headwinds for Japanese exporters as it reflects weak domestic demand and makes their products potentially more expensive in international markets.

Essay Format Questions

Analyze the interconnectedness of global financial markets as evidenced by the impact of US events (tariffs, Treasury yields) on other countries and regions mentioned in the provided excerpts.

Discuss the significance of government bond yields as indicators of economic conditions and investor sentiment, using examples from the US, Europe, and Asia presented in the text.

Compare and contrast the role and composition of the Dow Jones Industrial Average with at least one international stock market index (e.g., Japan's Nikkei or India's Nifty), highlighting their importance for their respective economies.

Evaluate the potential impact of geopolitical developments, such as trade tensions and international conflicts, on investment decisions and global market stability based on the information provided.

Explore the various ways international investors can gain exposure to foreign markets, referencing specific instruments like ETFs and ADRs mentioned in the text, and discuss the potential benefits and risks of each.

Glossary of Key Terms

IPO (Initial Public Offering): The first sale of stock by a private company to the public, often used to raise capital.

Tariff: A tax imposed by a government on goods and services imported from other countries.

Global Sell-off: A widespread decline in prices across various financial markets around the world.

Counter-tariff: A tariff imposed by a country in retaliation against another country's tariffs.

Equities: Stocks or shares representing ownership in a company.

Commodities: Raw materials or primary agricultural products that can be bought and sold, such as oil and metals.

Geopolitical: Relating to the interplay of international politics and geographical factors.

Government Bonds: Debt securities issued by a national government to finance its spending.

Yield (on a bond): The rate of return on a bond, calculated as the annual interest payment divided by the bond's current market price.

Risk-off Market Condition: A market environment where investors tend to avoid riskier assets and move towards safer investments, such as government bonds.

Haven Assets: Investments that are expected to retain or increase in value during times of market turbulence.

ECB (European Central Bank): The central bank of the Eurozone, responsible for the monetary policy of the countries that have adopted the euro.

Rate Cut: A reduction in the central bank's benchmark interest rate.

Fiscal Concerns: Worries about a government's spending, debt, and overall financial health.

Gilt Yields: The yields on UK government bonds (gilts).

JGB (Japanese Government Bond): Debt security issued by the Japanese government.

National People's Congress (NPC): The national legislature of the People's Republic of China.

Stimulus (economic): Measures taken by a government or central bank to boost economic activity.

Repo Rate (Repurchase Agreement Rate): The rate at which a central bank lends money to commercial banks against the security of government bonds.

GDP (Gross Domestic Product): The total monetary or market value of all the finished goods and services produced within a country's borders in a specific time period.

Intra-market Analysis: Analyzing relationships and movements within a specific market (e.g., the US stock market).

Dow Theory: A stock market theory that claims the market is in an upward trend if one of its averages advances beyond a previous important high and is accompanied or followed by a similar advance in the other average.

RSI (Relative Strength Index): A momentum indicator used in technical analysis that measures the magnitude of recent price changes to evaluate overbought or oversold conditions in the price of a stock or other asset.

MACD (Moving Average Convergence Divergence): A trend-following momentum indicator that shows the relationship between two moving averages of a security’s price.

Bond ETF (Exchange Traded Fund): A type of ETF that invests in a portfolio of bonds, allowing investors to gain exposure to the bond market.

ADR (American Depositary Receipt): A certificate representing shares of a foreign company's stock that are traded on U.S. stock exchanges.

Index Component: A stock or other security that is part of a specific market index (e.g., a component of the S&P 500).

Technical Outlook: An analysis of a security or market based on historical price movements and trading volume data, often using indicators to predict future price trends.

NotebookLM can be inaccurate; please double check its responses.

Share this post