-Foreword-

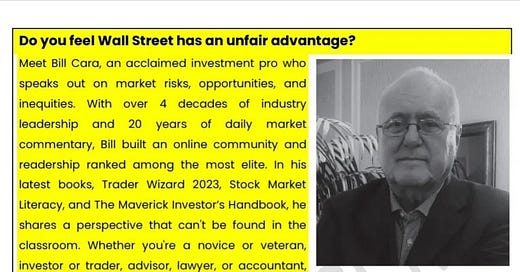

If you have been following my work, you already know I attribute a lot of my learning to Bill Cara and his work. He is relaunching an extensive Weekly report that covers the entirety of the market, and it is over 300 pages long with institutional level insight with a macro lens on the global machine that is the “Market”.

When Bill used to publish weekly reports starting in 2013, I initially understood a very small percentage of the report. I slowly began to chip away and tried to learn and much as I could week to week, researching the topics I did not understand. I then began to question him and do my own research on why Bill said certain things or why he was focusing on a particular piece of the jigsaw puzzle.

Here is the latest AI generated podcast that summarizes the full report. At over 300 pages this macro view of the global markets is institutional level content and is a sample preview. Eventually it will be for Bill’s paid subscription at his website Billcara.com

Briefing Doc

This briefing document summarizes key themes and data points from the provided excerpts of "BillCaraWeek5.pdf" and "Week in Review 4.pdf," focusing on currencies, bonds, stock market indices, and international investment opportunities.

I. Currency Markets:

The documents extensively list currency pairs, indicating a broad overview of global forex markets. Many of these pairs are categorized as "(NBD)," suggesting New Bid Data. Examples include:

"British Pound to New Zealand Dollar (NBD) $GBPNZD GBP/NZD"

"Euro to US Dollar (NBD) $EURUSD EUR/USD"

"US Dollar to Japanese Yen (EOD) $USDJPY USD/JPY"

Focus on major currencies like the US Dollar, Euro, British Pound, Canadian Dollar, Japanese Yen, Swiss Franc, Australian Dollar, and New Zealand Dollar.

Includes emerging market currencies such as the Mexican Peso, Singapore Dollar, South African Rand, and Swedish Krona.

II. Government Bonds & Yields:

Tracks US Treasury yields for various durations (1-month to 30-year).

Includes a list of country-specific 10-year treasury yields.

Mentions "All government securities are treasury debt instruments backed by the goodwill of the issuing country (the full faith and credit concept) and the ability of the country's treasury department to pay the interest and repay the debt at the end of the term."

Indicates that central banks influence treasury debt rates. "A country's central bank establishes treasury debt rates when issued by controlling the funds available to private banks to buy them."

III. Equity Markets & Indices:

US Markets: Emphasis on the Dow Jones Industrial Average (DJIA), Dow Jones Transportation Average (DJTA), and Dow Jones Utility Average (DJUA) as key benchmarks for the US economy. "A nation's economy is driven by its industry, commerce, and finance. The 30 US company components of the Dow Jones Industrial Average (DJIA) are a leading benchmark of the economy in the broadest terms."

Provides a list of DJIA components linked to Value Line studies (e.g., AAPL, MSFT, AMZN).

Utilizes Point & Figure charts to assess market trends. "Can the Dow 30 break up through a Double Top on the PnF chart, or is it time to rest?"

Technical analysis using RSI and MACD indicators.

International Markets:Covers indices and ETFs in various regions including Europe (Germany, Netherlands, Sweden, UK, Italy), Asia (India, Singapore, Japan), and South America.

Focuses on tracking stocks that trade in both domestic and US markets, suggesting arbitrage opportunities. "To track a stock from any international issuer across multiple markets, possibly for arbitrage purposes, understand that some foreign issuers have stock that trades in American Depositary Receipt (ADR) form and some in the same security."

Sector Analysis:Examines specific sectors like Utilities, Consumer Discretionary, Gold Miners, and Silver Miners.

Lists key companies within each sector. For example, gold miners include "AEM AEM - Agnico Eagle Mines Ltd." and consumer discretionary stocks include "MAT - Mattel, Inc, MAR - Marriott International, Inc".

IV. Technical Analysis & Trading Signals:

Employs a scoring system for buy/sell signals based on moving averages and indicators.

"Buy signal: +1."

"Sell signal: -1."

"Neutral signal: 0."

Uses RSI (Relative Strength Index) to identify overbought/oversold conditions. "Oversold (<30): Potential buy." "Overbought (>70): Potential sell."

Utilizes MACD (Moving Average Convergence Divergence) for trend analysis.

V. International Investment Opportunities:

Provides extensive lists of companies trading in various countries, including those available as ADRs in the US.

Highlights the availability of country-specific and regional ETFs, allowing investors to gain exposure to specific markets.

Emphasizes the importance of understanding local market dynamics. "Japan's economy and domestic stock market offer investible opportunities in all sectors. However, understanding the Yen Dollar trade is crucial to success."

Offers links to resources like Investing.com and Yahoo Finance for accessing market data and screeners.

VI. Bonds:

Discusses corporate bonds, including convertible, municipal, and high-yield (junk) bonds. "Corporate bonds, such as convertible, municipal, and high-yield (junk), appeal to various investors."

Mentions convertible bonds, which can be converted into company stock. "Convertible bonds are convertible into a predetermined amount of the company's stock at certain times during the bond's life."

VII. Dow Theory:

The document emphasizes the importance of Dow Theory. “In this section, we look at the three Dow indexes, which combine to underlie the Dow Theory. Unlike so-called cryto currency, Dow Theory actually has a legitimate foundation – the US economy.”

VIII. Key Takeaways:

The documents offer a broad overview of global financial markets, including currencies, bonds, and equities.

Technical analysis is a key component of the investment strategy, utilizing indicators like RSI and MACD.

International diversification is encouraged, with a focus on understanding local market conditions.

The US economy remains the foundation, and the three components of the Dow Jones indexes are key economic indicators.

Study Guide

I. Key Concepts Review

Currency Pairs: Understand the notation (e.g., EUR/USD) and how exchange rates are quoted. Be able to identify base and quote currencies.

Government Bonds & Yields: Familiarize yourself with different maturities (e.g., 3-year, 10-year Treasury Yield) and their significance as economic indicators. Know how to access yield data and charts (e.g., Investing.com, StockCharts.com). Understand that a bond price rises or falls in the market.

Dow Theory: Grasp the basic principles of the Dow Theory and how the DJIA, DJTA, and DJUA are used to assess the US economy.

Technical Indicators: Review how to interpret RSI (Relative Strength Index) and MACD (Moving Average Convergence Divergence) signals. Understand overbought and oversold conditions.

Gold and Silver Mining Stocks: Know some of the key producers, ETFs and be able to interpret technical outlooks.

Consumer Discretionary Stocks: Recognize the industry bellwethers in this sector and trading performance and technical outlooks.

International Indices and ETFs: Understand the role of stock market indices as benchmarks. Be familiar with country-specific indices (e.g., Nifty in India, AEX in Netherlands, OMX in Sweden) and ETFs. Learn how to find and track these indices and ETFs using Yahoo Finance and Investing.com.

ADRs (American Depositary Receipts): Define ADRs and their purpose, especially in tracking international stocks in the US market. Understand the difference between sponsored and unsponsored ADRs.

Sector Analysis: Know leading companies of various sectors such as Oil and Gas, Basic Materials, Industrials and Transports, Telecom Services, and Utilities in different markets.

II. Quiz (Short Answer)

What does the acronym NBD stand for in the context of currency pairs?

What are the three Dow Jones Averages, and what aspect of the US economy does each represent?

Explain the significance of a 10-Year US Treasury Yield as an economic indicator.

How can the Relative Strength Index (RSI) be used to identify potential buying or selling opportunities?

What is the role of the Monetary Authority of Singapore (MAS)?

What is an ADR, and why is it used for international stocks trading in the US?

Name three Oil and Gas Integrated companies mentioned and their countries of origin.

Define what is meant by "full faith and credit concept" in the context of government securities?

What does the Dow Theory measure as opposed to cryptocurrency?

What are retractable and redeemable bonds?

III. Quiz Answer Key

NBD stands for the New York Board of Trade, which is a market where currency pairs are traded.

The three Dow Jones Averages are the Industrial Average (DJIA, representing industry), the Transportation Average (DJTA, representing the transportation of goods), and the Utilities Average (DJUA, representing utility services); combined, they provide insight into the overall US economy.

The 10-Year US Treasury Yield is a benchmark interest rate often used to gauge investor confidence, inflation expectations, and the overall health of the economy; it also influences other interest rates, like mortgage rates.

The RSI measures price momentum; an RSI above 70 suggests the asset is overbought and may be a potential sell signal, while an RSI below 30 suggests the asset is oversold and may be a potential buy signal.

The Monetary Authority of Singapore (MAS) is Singapore’s central bank, responsible for regulating the financial industry, issuing currency, and overseeing monetary policy.

An ADR (American Depositary Receipt) represents shares of a foreign company trading on US stock exchanges; it allows US investors to invest in international companies without dealing with foreign exchanges or currencies.

Three Oil and Gas Integrated companies mentioned are Petrobras (Brazil), Shell (Netherlands), and Chevron (USA).

The "full faith and credit concept" in the context of government securities means the debt instruments are backed by the issuing country's ability to pay interest and repay the debt at the end of the term.

The Dow Theory has a foundation in the US economy, measuring industry, commerce, and finance.

Convertible bonds are convertible into a predetermined amount of the company's stock. When the conversion feature is at the company's discretion, it is called a retractable bond; if it is at the holder's discretion, it is called a redeemable bond.

IV. Essay Questions

Discuss the relationship between the Dow Theory and the current state of the US economy. How effectively do the DJIA, DJTA, and DJUA reflect economic realities, and what are their limitations?

Compare and contrast the factors influencing the performance of gold mining stocks versus consumer discretionary stocks. How do macroeconomic conditions and investor sentiment affect each sector differently?

Analyze the role of government bond yields in shaping investment strategies. How can investors use information about Treasury yields to make informed decisions about asset allocation and risk management?

Explain the purpose of ADRs (American Depositary Receipts) in facilitating international investing for U.S. investors, and outline the potential risks and rewards associated with investing in ADRs.

Select a specific country covered in the readings (e.g., Netherlands, Sweden, India) and analyze the key indices and ETFs available for investors interested in that market. What are the primary sectors represented, and what factors should an investor consider before investing in these instruments?

V. Glossary of Key Terms

ADR (American Depositary Receipt): A certificate representing shares of a foreign stock trading on a U.S. stock exchange.

Currency Pair: The quotation of the relative value of two different currencies (e.g., EUR/USD).

Dow Theory: A stock market theory that states the market is in an upward trend if one of its averages (DJIA) advances above a previous important advance and is accompanied or followed by a similar advance in the other average (DJTA).

DJIA (Dow Jones Industrial Average): A stock market index that tracks 30 large, publicly-owned companies trading on the New York Stock Exchange (NYSE) and the NASDAQ.

DJTA (Dow Jones Transportation Average): A stock market index that tracks 20 transportation companies.

DJUA (Dow Jones Utilities Average): A stock market index that tracks 15 utility companies.

ETF (Exchange-Traded Fund): A type of investment fund that holds a basket of assets (like stocks or bonds) and trades on stock exchanges like a single stock.

MACD (Moving Average Convergence Divergence): A trend-following momentum indicator that shows the relationship between two moving averages of a security’s price.

NBD (New York Board of Trade): A market where currency pairs are traded.

RSI (Relative Strength Index): A momentum indicator used in technical analysis that measures the magnitude of recent price changes to evaluate overbought or oversold conditions in the price of a stock or other asset.

Treasury Yield: The return an investor receives on a government bond, expressed as a percentage.

Eurodollar Index: This measures the value of U.S. dollars held in foreign banks, typically in Europe, and is often used as a benchmark for short-term interest rates.

Sovereign Debt: Debt issued by a national government, often in the form of bonds.

Technical Indicators: Calculations based on price and volume data to forecast market direction.

Retractable Bond: Convertible bonds are convertible into a predetermined amount of the company's stock when the conversion feature is at the company's discretion.

Redeemable Bond: Convertible bonds are convertible into a predetermined amount of the company's stock when the conversion feature is at the holder's discretion.

NotebookLM can be inaccurate; please double check its responses.

Share this post