In celebration of reaching 250 Podcast Episodes I am extending a 25% off discount on paid content.

Paid Episode 41 min

Free Episode 32 min

You have likely lost more on 1 trade this year than my annual $240 subscription. Not upgrading could be costing you each day. Testimonials can be found here

One Example:

“Thanks for consistent, quality content. It’s educational and has paid for itself several times over.

Even though I don’t actively trade, there’s so much usefulness in the daily podcast for navigating the bigger picture for my 401(k) and IRA. Often you touch on factors that will impact my clients at my day job, so it’s useful there too.

Finally, and perhaps most importantly, there’s a “Zen and the art of” quality to your world. it’s educational, elucidating, and exists at the intersection of theory and practice. Thoughtful and worthwhile!" - Will (Paying Subscriber)

Follow me on Substack Notes

Podcast Available on Spotify | Apple | Amazon

Prevent Sim Swap Hacks by switching to Efani. My subscribers get $99 off. Use code NYUGRAD, automatically should be added after below landing page. If you want multiple lines for family or business, message me and I can introduce you for white glove service.

Here is their FAQ video. I plan to have Mark as a podcast guest soon.

100% Protection from SIM Swaps

$5 Million Insurance Policy through Efani

Learn more here: https://www.efani.com/nyugrad

FBI Reported a 5.67X Increase in SIM Swap Scams Last Year

80% of Cellphone Hack Attempts are successful

$42,209 = Average Loss per victim

FAQ Video

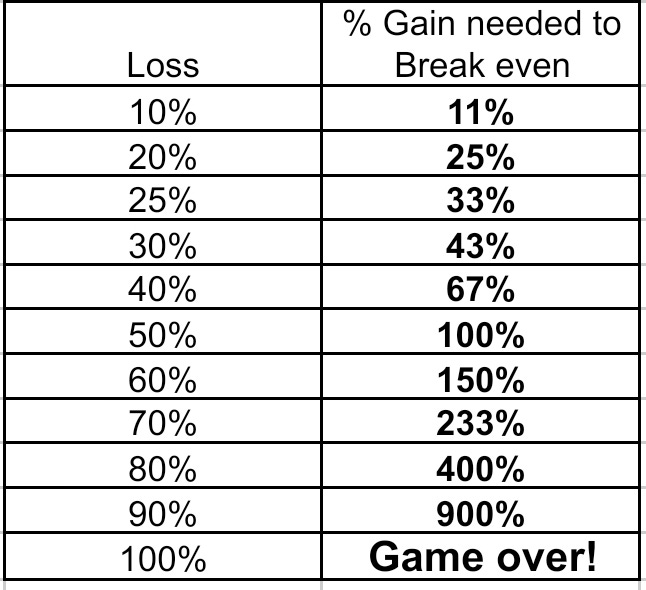

Save this spreadsheet or memorize it

Summary of the day

Monday is gonna be another doozy. Unless the fed makes some statement. And the Bank of Japan are punished for trying to kill the yen carry trade.

Important vold breadth lesson. Knowing when not to buy dips. Chart 3:48pm…on paid chat:

“Be careful buying the dips! Tight stops

Still no buying oomph in sight. Expect a flush down if none appears”

How did we end the day?

By Bill Cara

Shit show started in Japan last night as a continuation from Thursday.

Selling never let up.

10 yr fell to 3.8% why? Rotation into safety. Bonds are in high demand. As bond prices rise their yields fall.

I suspect a ton of margin calls as many people and institutions were overleveraged long AI names.

VIX up 50% all day

1192 ETFs Hold Nvidia (NVDA)

https://www.tipranks.com/stocks/nvda/etf-exposure

1240 ETFs Hold Microsoft (MSFT)

https://www.tipranks.com/stocks/msft/etf-exposure

1084 ETFs Hold Apple (AAPL)

https://www.tipranks.com/stocks/aapl/etf-exposure

998 ETFs Hold Alphabet Class A (GOOGL)

https://www.tipranks.com/stocks/googl/etf-exposure

981 ETFs Hold Amazon (AMZN)

https://www.tipranks.com/stocks/amzn/etf-exposure

733 ETFs Hold Alphabet Class C (GOOG)

https://www.tipranks.com/stocks/goog/etf-exposure

744 ETFs Hold Tesla (TSLA)

https://www.tipranks.com/stocks/tsla/etf-exposure

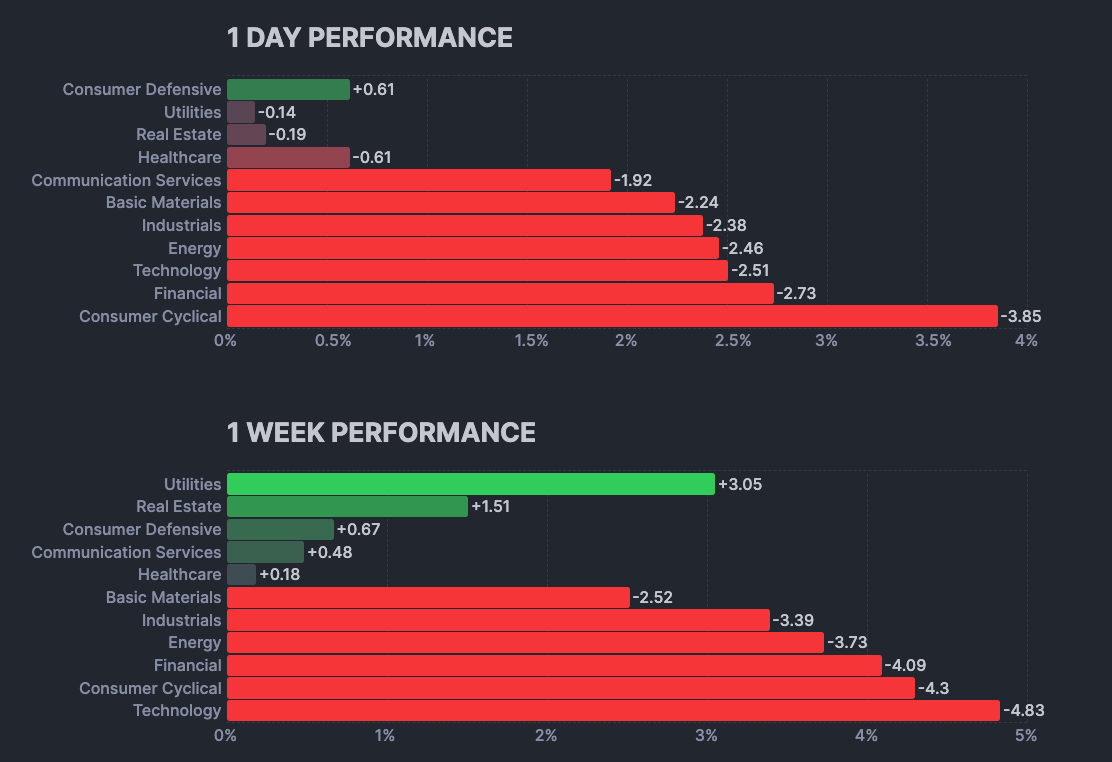

Breadth

485 new highs

589 new lows

Nasdaq New Highs/Lows 84 Highs vs 231 Lows

18% advancing 80% declining

57% below 50 day ma

40% below the 200 day ma

Stuck out

Nothing was spared outside of Prec Metals and bitcoin

Strong

Weak

What to watch

Watch mag 7

Watch yields

Credit card delinquency rate (1991-Present)

Whether you subscribe for free or paid, you will gain value and ability over time to see stock market price movement in a way Wall St does not want you to see.

At the very least, improve your own education so you can grade your financial advisors homework and performance!