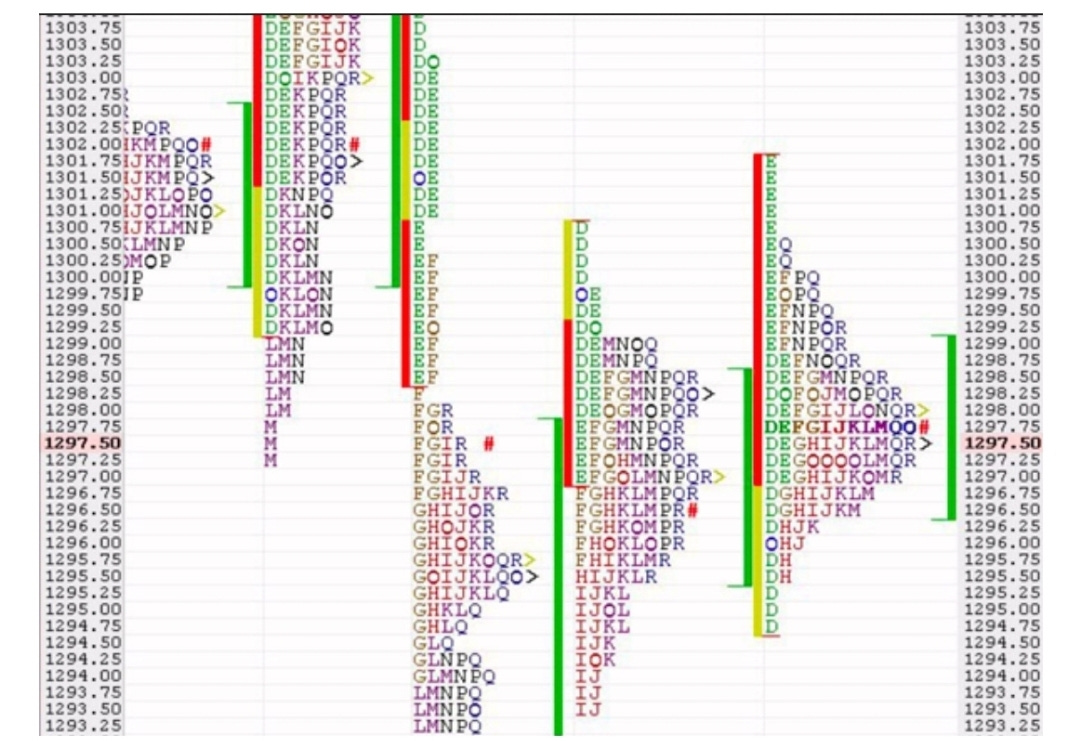

This article was lost this summer by my fat finger and I would like to share it again. But a quick glance at S&P futures for the past few weeks serves as a perfect example of the lesson I am sharing. This 1st chart is from 8:35am premarket.

Please let me know if you have questions in the comments.

(Originally shared May 1, 2022)

Prices of anything have only three phases. "No it is not up vs down. Those are simply by products of below:

In Balance

Seeking a new balance area

Random chop

That is it. Whether you are talking about groceries, Air Jordans, Porsche GT3 w/manual, homes, stocks, or bonds.

Market profile charts display price, volume, and time frame on a single chart, indicating the value areas and points of control for a stock.

It emphasizes price location and the time spent there. This is unique way to look at price as we all trade price, not time.

A typical Market Profile chart looks like this:

Training your eyes

I am not sure if was divine message or confirmation bias, but I see market profiles everywhere in the natural world, but the first that hit me like ton of bricks were skylines of cities I travel to. Whether it’s Japan, Seoul, Singapore, Vancouver or London the skyline always shows me a market profile.

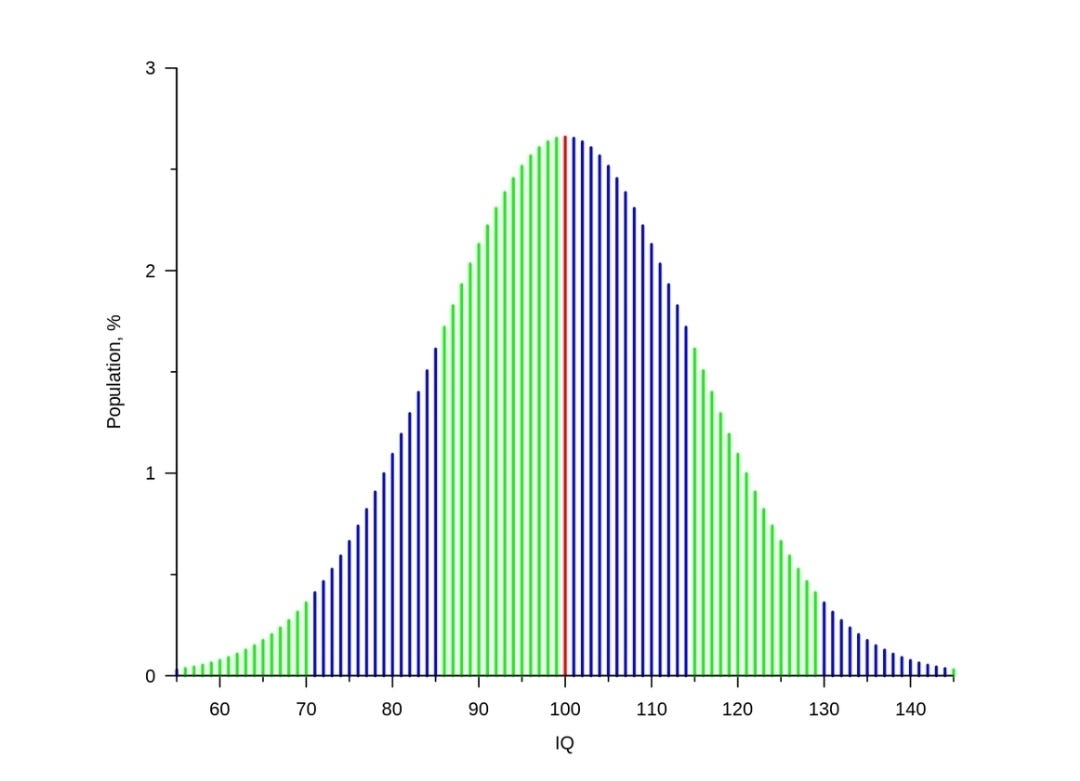

But why do almost all balance areas look like a bell curve on its side? This is not a coincidence.

“I know of scarcely anything so apt to impress the imagination as the wonderful form of cosmic order expressed by the “Law of Frequency of Error”. The law would have been personified by the Greeks and deified, if they had known of it. It is the supreme law of Unreason. Whenever a large sample of chaotic elements are taken in hand and marshalled in the order of their magnitude, an unsuspected and most beautiful form of regularity proves to have been latent all along.” - Sir Francis Galton