Podcast Available on

Spotify | Apple | YouTube | Amazon

Follow me on Substack Notes

33% Discount Ends Jan 1, 2024.

It has been less than six months and I want to thank the 1800+ Subscribers who support the Substack! Going into the holidays I wanted to put together a special promotion which will cost you nothing now, but help show support for the work I am doing.

33% discount for Pledging to the future paywall (Annual, Monthly or Founders)

I plan to turn on premium when we surpass 3000+ total subs

Pledging requires a credit card but it is not charged until Premium goes live

What will premium include? (at minimum)

Watchlist(s) (Bullish, Bearish, Price levels, if then scenarios)

Webcasts covering charts of all above

Additional Premium only content

Timing: promotion good through Jan 1, 2024

I want in! How?

Instructions:

Subscribe by clicking “Subscribe” or this link.

Once you are a subscriber, you should see buttons that say “Pledge your support”

Enter your information on a page that looks like below

Show Notes

Summary of the day

The title wasn’t a typo. Someone is withholding the truth.

% of companies with strong/healthy Altman Z-scores (which combine account profitability, leverage, liquidity, solvency, activity ratios, etc. to measure bankruptcy risk) has dropped below 10% for first time on record per @fathommacro @lizannsonders.

https://twitter.com/LizAnnSonders/status/1732743034100428951

Jobs data beat this morning. It was the Goldilocks print. Not too hot not too cold. Won’t trigger Powell to raise, yet Americans are still gainfully employed, is the deduction

Jobs data has been revised down almost every time this year after the fact!

Consumer credit has never been higher in the history of Homosapien

This has been the longest period of yield curve inversion in financial market history

$VIX is pricing in no landing

#Bitcoin $BTC is pricing in a useless faux currency

Magnificent 7 made up 80% of the S&P 500 YTD gains in 2023

all consumer stimulus programs are now past us

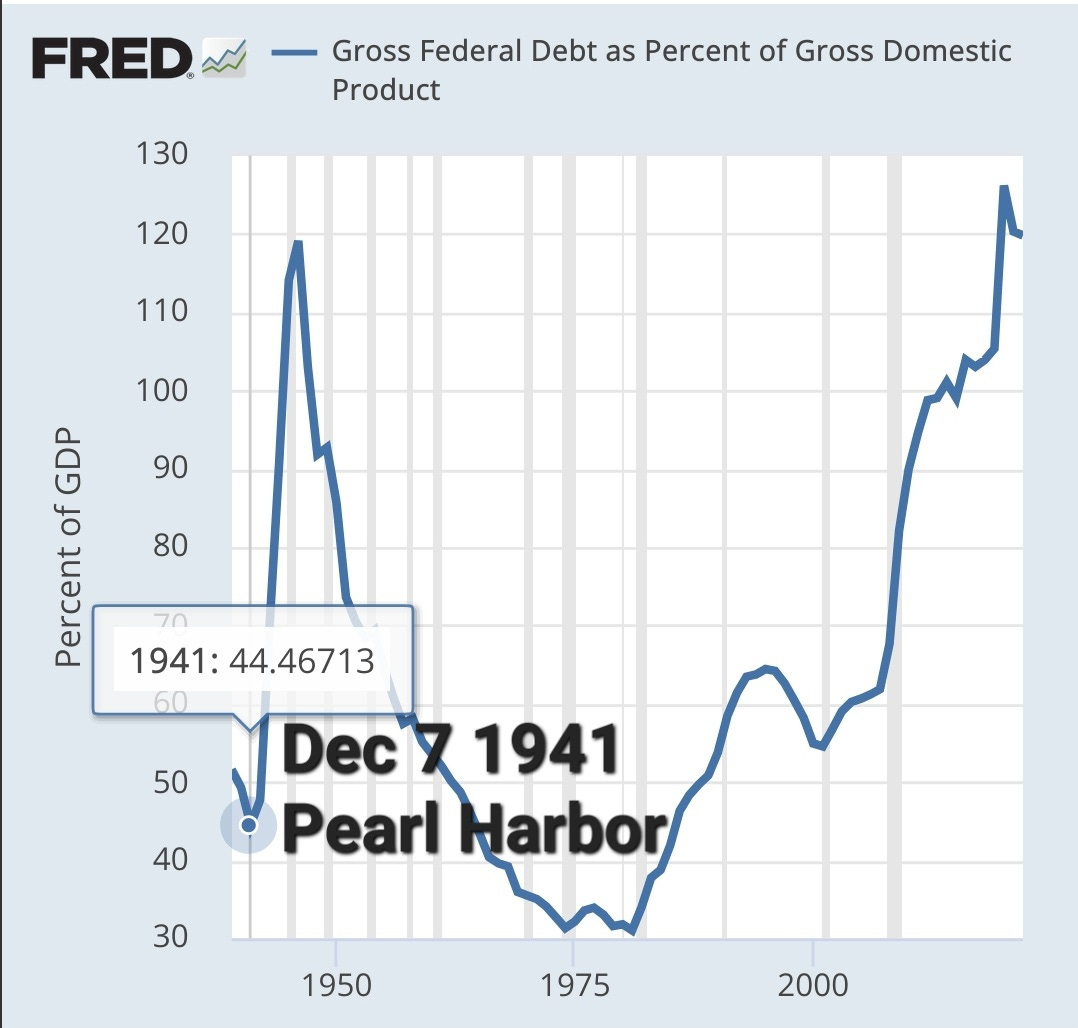

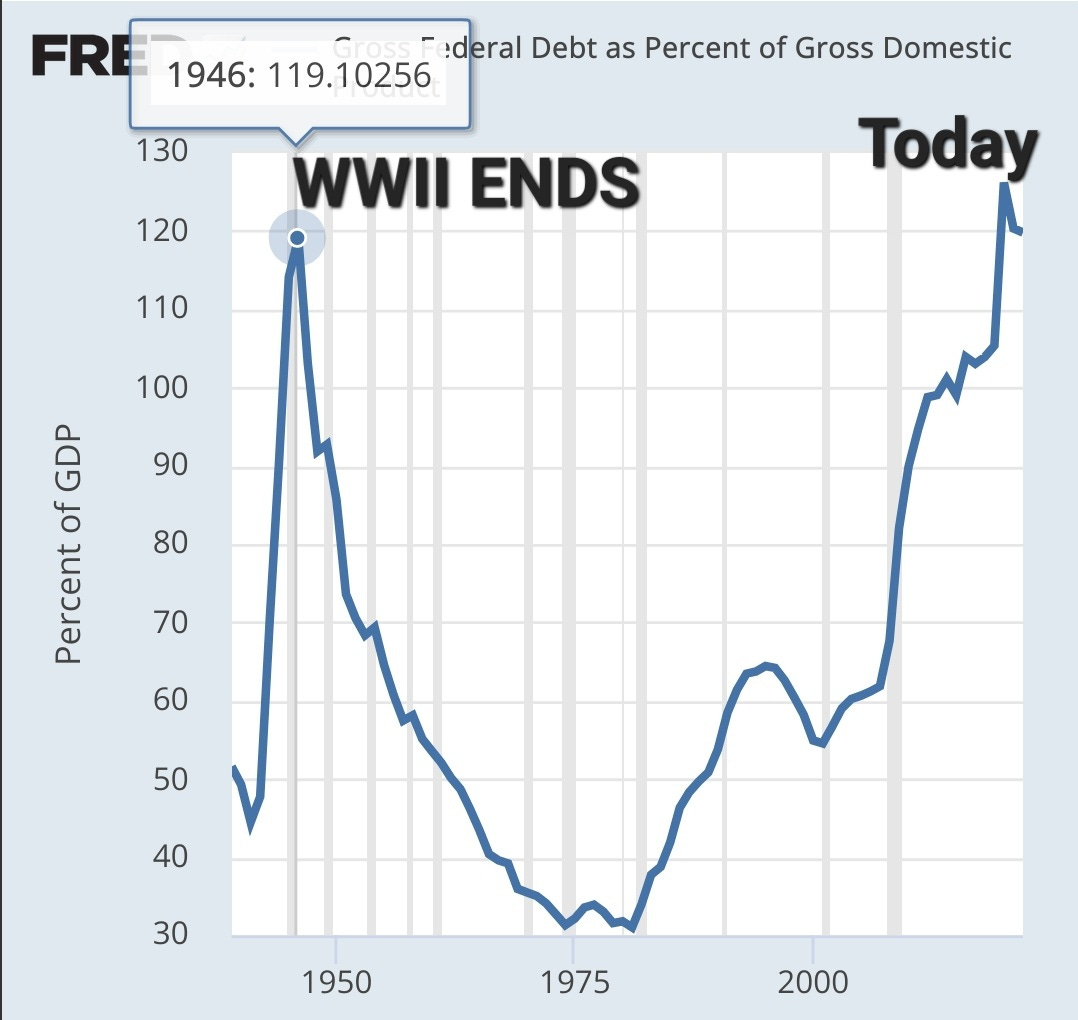

The last time Gross Federal Debt as Percent of Gross Domestic Product was at this level, World War II was ending and we went deep into debt to defeat the enemy.

2024 financial markets are 100% going to either move violently lower or higher. I don’t expect a tight range. The real world experience may also be very extreme. It is time to get our own houses in order and be strong mentally, spiritually, physically, & financially so that we can provide for our families.

Breadth

583 new highs

154 new lows

56% advancing 38% declining

24% below 50 day ma

41% below the 200 day ma

Stuck out

Stocks are on a 6 week win streak

SPY is 7 points away from lifetime highs, SPX 204 points away

Breadth is still strong to the positive

Strong

Energy, Tech and Financials lead

Weak

Gold

GDX down 2.11%

Yields week for the past month but trying to stop going down at 4.2%

What to watch

Watch yields

Watch Mag 7

Economic data

Share this post