Podcast Available on

Spotify | Apple | YouTube | Amazon

Follow me on Substack Notes

33% Discount Ends Jan 1, 2024.

It has been less than six months and I want to thank the 1,800+ Subscribers who support the Substack! Going into the holidays I wanted to put together a special promotion which will cost you nothing now, but help show support for the work I am doing.

33% discount for Pledging to the future paywall (Annual, Monthly or Founders)

I plan to turn on premium when we surpass 3000+ total subs

Pledging requires a credit card but it is not charged until Premium goes live

What will premium include? (at minimum)

Watchlist(s) (Bullish, Bearish, Price levels, if then scenarios)

Webcasts covering charts of all above

Additional Premium only content

Timing: promotion good through Jan 1, 2024

I want in! How?

Instructions:

Subscribe by clicking “Subscribe” or this link.

Once you are a subscriber, you should see buttons that say “Pledge your support”

Enter your information on a page that looks like below

Show Notes

Summary of the day

FOMC declaring victory on inflation is akin The Japanese Empire declaring they will fight until the end, right before the B-24 flew their two missions in WWII.

On Nov 5 Podcast #84 I noted the Fed basically pivoted. But now the public media and wall st are also declaring such.

The data the Fed is spewing at us is completely ficticious.

Stocks are melting up

But trouble is showing up with real inflation. USD and yields sold off hard. Oil, hard assets and crypto are now also spiking

Home builders and loan product sellers are exploding.

The household is about to get hit with another inflation bomb.

The things the fed doesnt count that take up more than 60% of our take home pay, are about to go higher in price while the USD falls.

Scary times

Here is a good summary of the FOMC news today. Joseph Wang runs Fedguy.com but used to be a trader on the Fed’s open market desk.

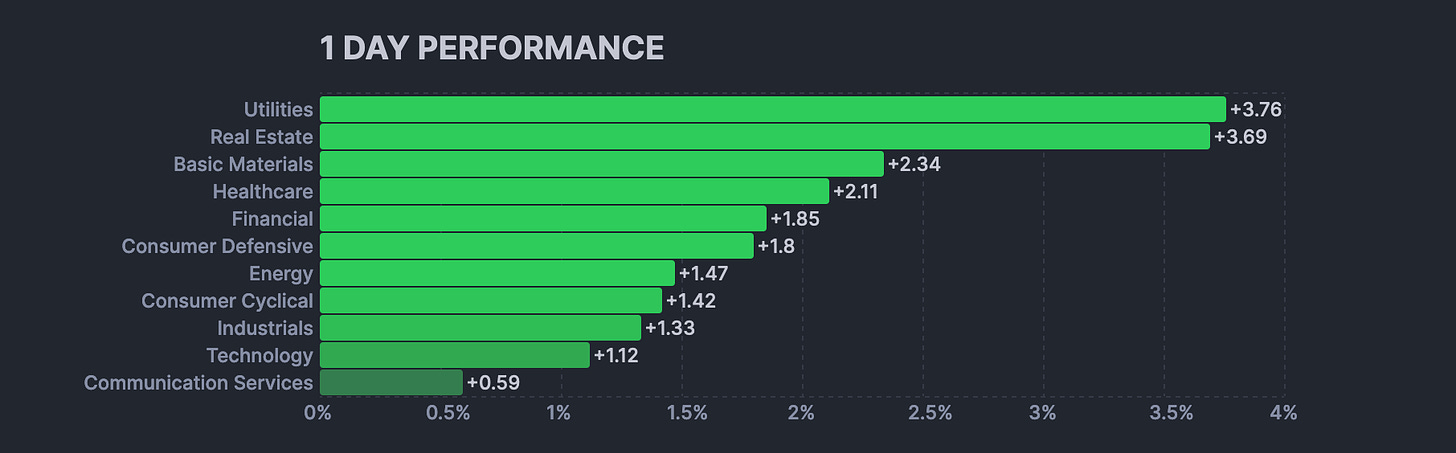

Breadth

1,471 new highs

243 new lows

82% advancing 14% declining

22% below 50 day ma

36% below the 200 day ma

Stuck out

Santa Rally is here.

Inflationary items seemed to bounce.

Oil

Home builders

Gold and Silver

Crypto

USD weak

Strong

All risk assets

But curiously Tech didn’t lead

Weak

USD

ADBE - on light quidance

ANYTHING BEARISH

What to watch

OIL

VIX

GOLD

BONDS

Watch mag 7

Watch yields

Economic data

Share this post