Podcast Available on

Spotify | Apple | YouTube | Amazon

Follow me on Substack Notes

33% Discount Ends Jan 1, 2024.

It has been less than six months and I want to thank the 1,800+ Subscribers who support the Substack! Going into the holidays I wanted to put together a special promotion which will cost you nothing now, but help show support for the work I am doing.

33% discount for Pledging to the future paywall (Annual, Monthly or Founders)

I plan to turn on premium when we surpass 3000+ total subs

Pledging requires a credit card but it is not charged until Premium goes live

What will premium include? (at minimum)

Watchlist(s) (Bullish, Bearish, Price levels, if then scenarios)

Webcasts covering charts of all above

Additional Premium only content

Timing: promotion good through Jan 1, 2024

I want in! How?

Instructions:

Subscribe by clicking “Subscribe” or this link.

Once you are a subscriber, you should see buttons that say “Pledge your support”

Enter your information on a page that looks like below

Show Notes

Summary of the day

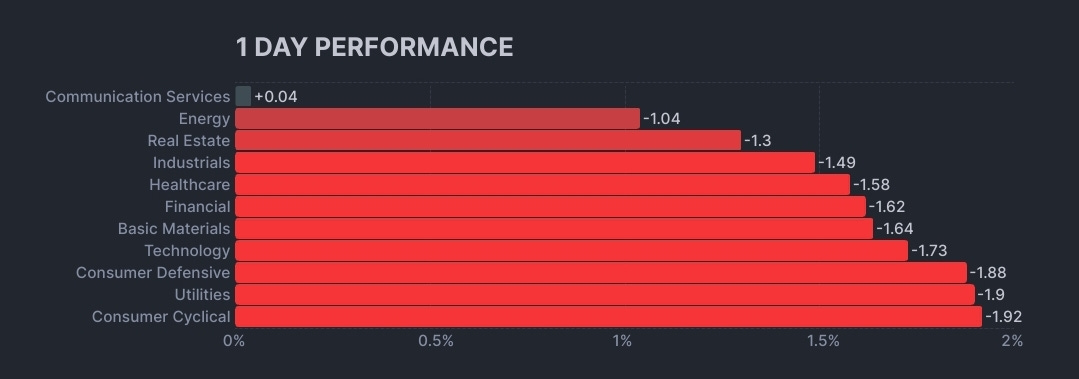

That was fun! Selling was furious and there was no real trigger.

Other than we are way overbought. This also why I advise people to not pursue 1 day or 0 day options. If you were long 0dte at lunch time, how do you recover?

I know everyone is drunk on green every day for weeks. But this is a time to be fearful. To lighten up. I have been banging the table that insurance was basically free up until today.

Outside Day

A chart pattern where the high is above the previous day's high and the low is below the previous day's low.

Outside Reversal Day

A two-day chart pattern that can indicate a reversal in trend. Like with outside days, the second day's high must be above the previous day's high, while the low must be below the previous day's low. In addition, the second day must close in the opposite direction of the previous trend (e.g. in an uptrend, the second day must close down). This pattern is similar to the engulfing candlestick pattern, but requires the entire range (high and low) to be engulfed, not just the open and close.

Breadth

1202 new highs

186 new lows

21% advancing 75% declining

21% below 50 day ma

34% below the 200 day ma

Stuck out

2:42pm the wheels started coming off. I posted real time right before. $VOLD began to fall and never stopped.

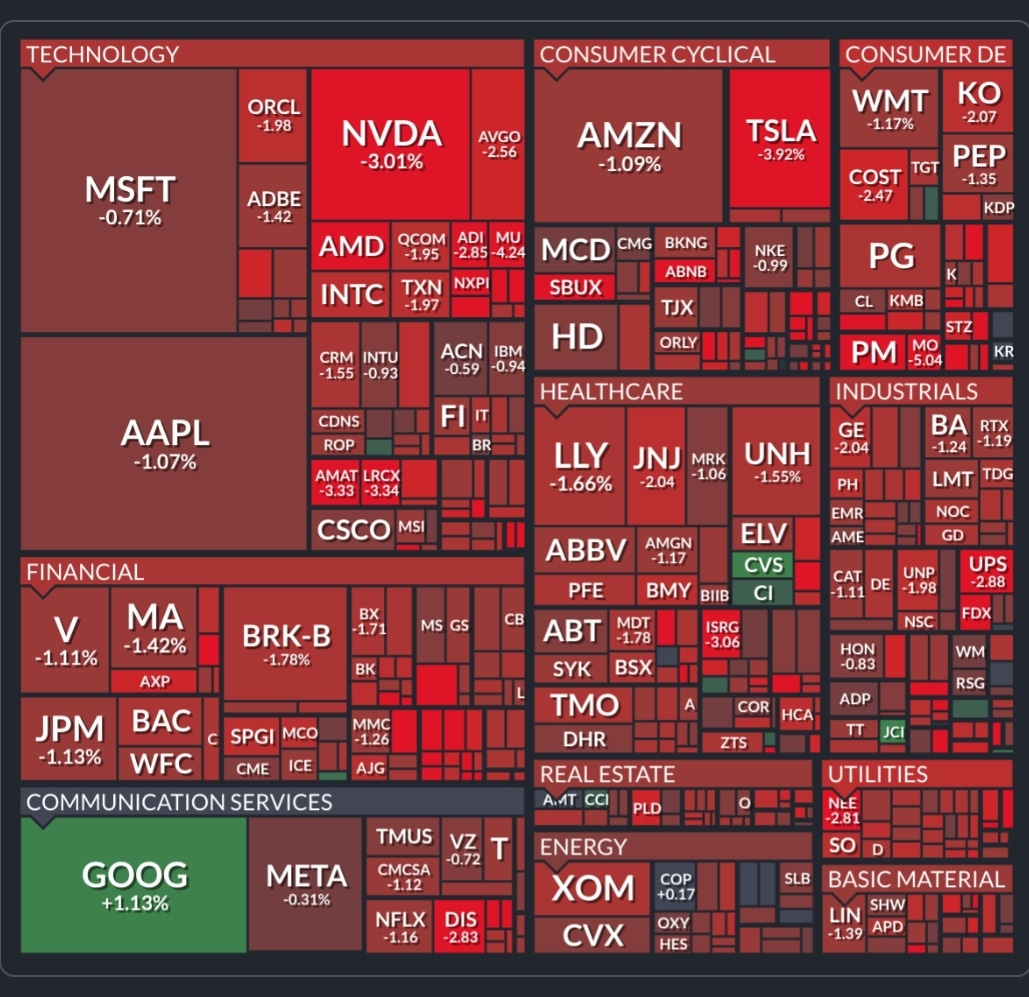

Strong

$VIX

Google up dispite it all

Weak

What to watch

Inflation and inflation sensitive areas

Ie Oil Gold USD $DXY yields etc

Watch mag 7

Watch yields

Economic data

Share this post