Available on Spotify | iTunes | Amazon Music

Twitter: nyugradsubstack

Threads: nyugrad.substack

New Referral program for existing Subscribers

Show Notes

Link to Bill Cara quote

After the close Fitch downgrades US credit rating from AAA to AA+. Hasn’t downgraded since 2011.

10 yr yield still 4%

$DXY (USD) up still above 100

Fewer job openings than last mo

At 10am mag 7 all red

All builders green 10am

Market in a nutshell

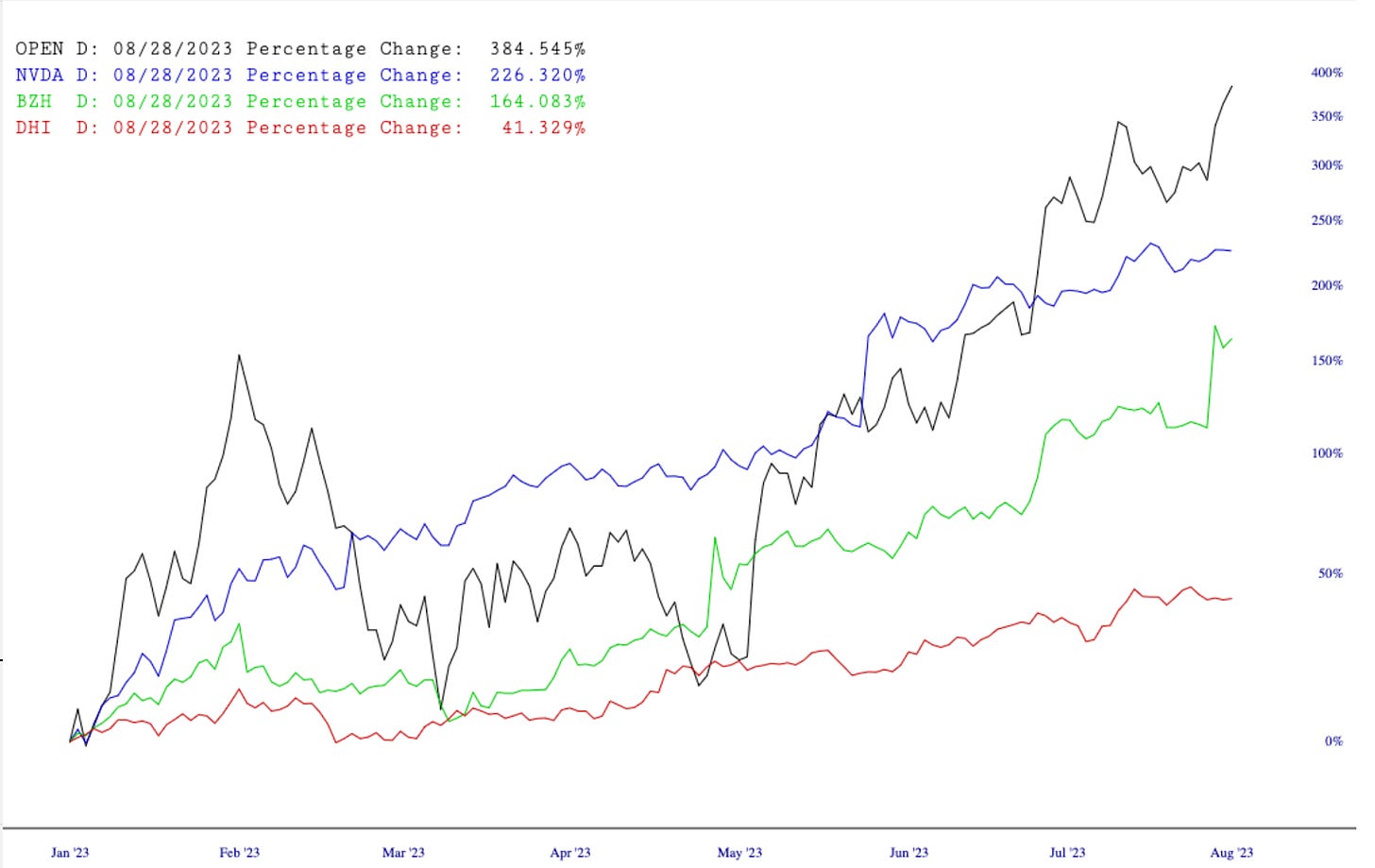

Open Door $OPEN outperforming NVDA

YTD $OPEN 386%

YTD $NVDA 226%

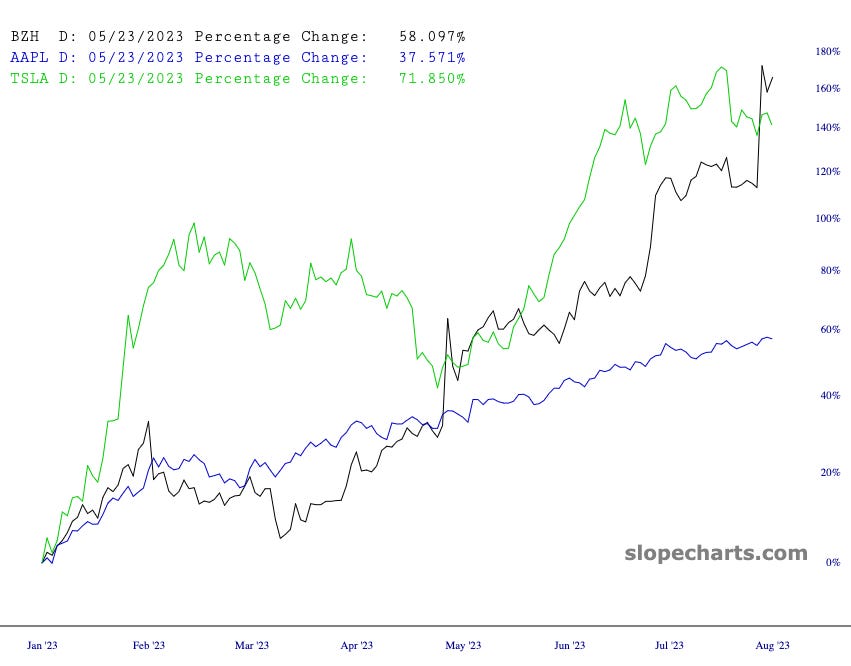

$BZH outperforming $AAPL $TSLA!

Watch $TLT. If bonds do go down, then Yields will rise to attract buyers. Then USD will also rise, pressuring risk assets like stocks, gold and silver. If yields rise then more options like 4% yielding savings account will keep popping up at $AXP and $JPM and $AAPL / $GS, offering real risk free alternatives to risky a$$ equities.

$TBT #BONDS

Strong

CAT 0.00%↑ up 9% on earnings

AMD 0.00%↑ up 2.7% AH on earnings. Revenue falls 18% as PC market shows continued weakness. Earnings down 40%/ Sales sown 18%

Weak

UBER 0.00%↑ down 4.9%

LYFT 0.00%↑ down 6% sympathy. Reports next wk

COIN 0.00%↑ down 7%

NCLH 0.00%↑ down 13%

JBLU 0.00%↑ down 6.6% on soft guidance

DASH 0.00%↑ down 3%

ETSY 0.00%↑ down 3%

NIO 0.00%↑ down 4.38%

WD 0.00%↑ 40% drop in sales. Worst loss ever. But not being punished down 2.4% AH

What to watch

USD, 10 Yr yield, Bonds, TLT, TBT, Yen, AAPL Amazon

Share this post