Available on Spotify | iTunes | Amazon Music

Twitter: nyugradsubstack

Threads: nyugrad.substack

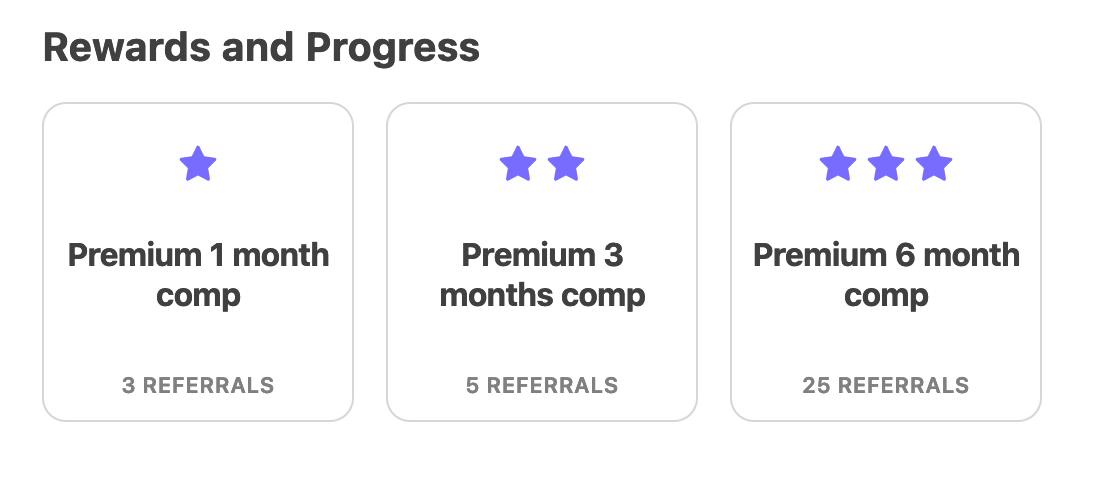

New Referral program for existing Subscribers

Show Notes

There aren’t many companies that can’t be replaced. Two companies that I believe fall in this category reported after the close today. Apple Computer and Amazon. Pause for a second. If Google vanished tomorrow, couldn’t MSFT 0.00%↑ #TikTok META 0.00%↑ pick up where we left off? It’s just cookies and ads!

But I do not believe you could replace the scale and economies of scale that AAPL 0.00%↑ and AMZN 0.00%↑ have built. Can Walmart pick up where your Amazon Prime account left off today if Amazon vanished tonight? Can Android or Samsung pick up where your Apple dependency left off tonight? Probably not.

I am typing this as I listen to the Amazon earnings call. Who can compete with their scale? delivery times? It would take so much capital and time to setup a competitor. Ask Walmart’s board.

If TSLA 0.00%↑ vanished tomorrow and AAPL 0.00%↑ stepped in and built EV refrigerators with wheels, would anyone miss Elon Musk? Probably not.

I still believe Apple and Amazon are going to keep their leadership position and use their scale, operating leverage, and cash war chest to crush future competitors.

Be cautious though, these two names are now blue chip safety stocks. it is very hard to fly when you are as large as they are. For now, AMZN 0.00%↑ is leveraging AWS to generate the large scale growth.

AAPL 0.00%↑ is becoming a PFE 0.00%↑ or PG 0.00%↑ and a ETF onto itself.

We are now in the cycle of finance where a few juggernauts are holding up all of our prosperity. And their prosperity also depends on the consumer continuing to #Brrrrrrrrrrrrrrrrr

PS Apple is soft ah on 3 qtrs of declining revenues and slowing iphone sales.

Vision Pro is still not shipping until 2024. By then I do not believe anyone will buy a $2k headset. $10B in deposits for Apple Card Savings is basically a marketed savings account. Is Apple a bank? Tech co? Utility? What is their multiple?

75%+ of the stock market have reported. There are a ton of wrecks and a few notables sticking their heads out swimming against the current.

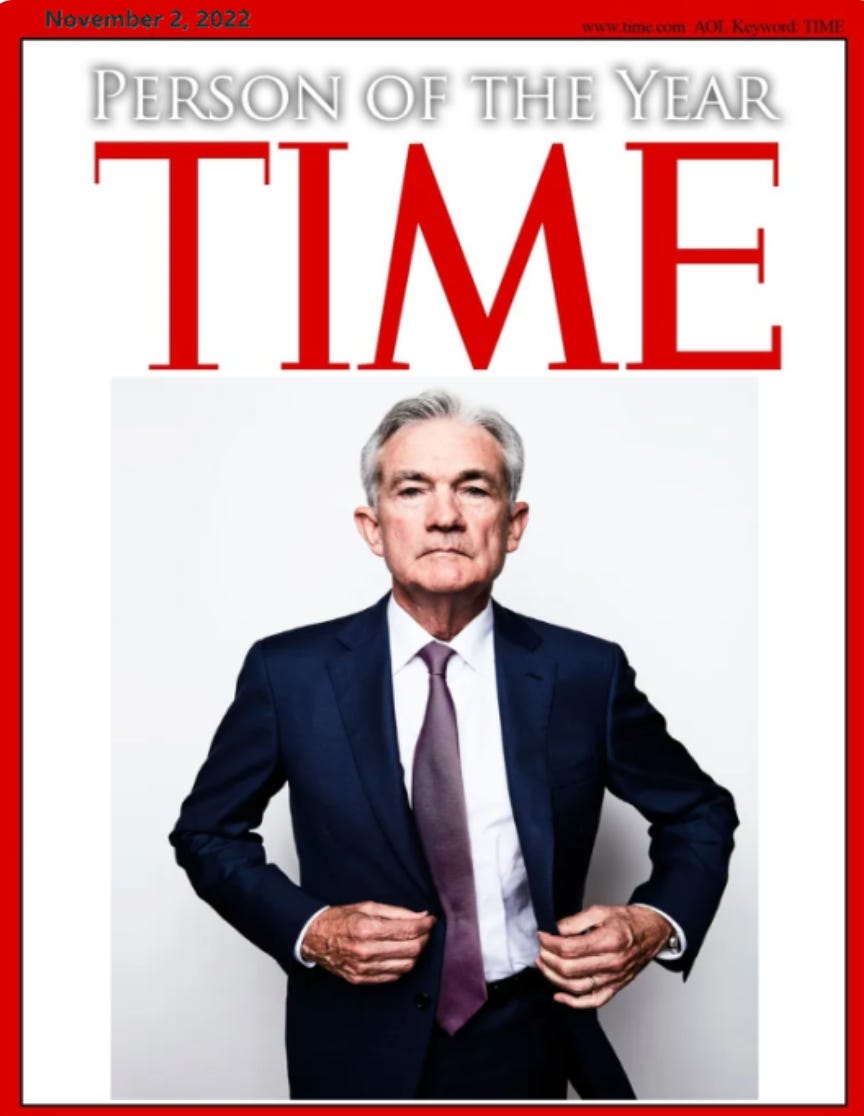

With earnings almost behind us, we go back to being held captive to the whims of two souls…

God help us all!

PS RIP Steve

Share this post