I had an audio issue and the audio only goes to 5 min 46 sec. But it was the majority of the content. The only piece that got lost was picked up on the show notes below in the section “Stuck out”.

One note I would like to add is that the indices are just as likely to go to new highs as new lows since its so heavily weighted to a few stocks. We are in the middle of a converging price zone and it seems the main event, as usual, will be the Fed Rate decision Wed Sep 20. That is when the Death Star will either zap the bulls or the bears.

Podcast Available on

Spotify | Apple Podcast | Amazon Music

Follow on Substack Notes

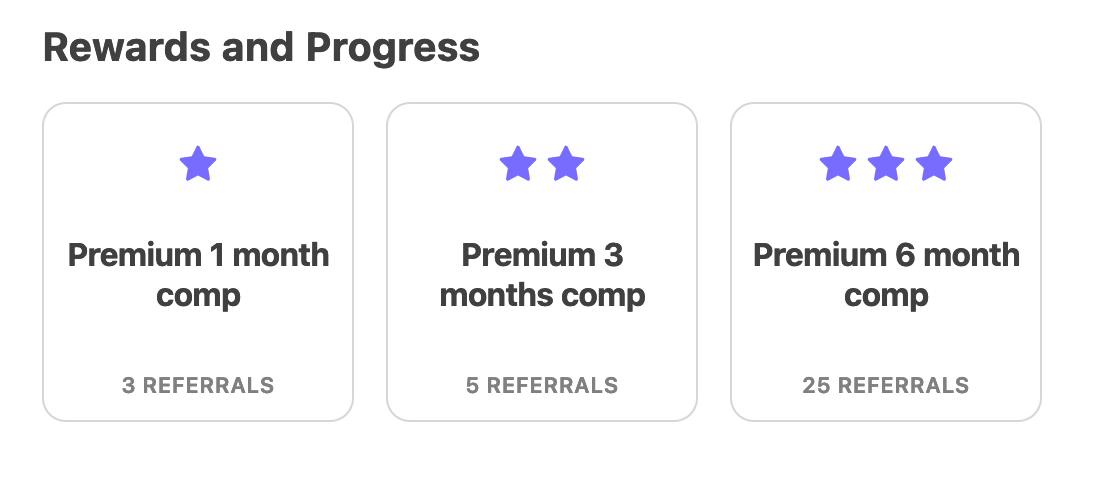

Referral Program for existing Subscribers

When you use the “Refer a friend” link below or the “Share” button on any post, you’ll get credit for any new subscribers. Here is the link you can copy and paste into any email, text or social media platform:

Once I launch a paywall, your referral credits earned will be retroactive immediately

Show Notes

Summary of the day

On the surface this chart is the entire story for the year. The next chapter starts next week with rate decision and guidance Sep 20 at 2pm ET. As you can see in the chart, we can easily go up to new highs or crack the teal and or purple lines of support below.

For the broader market we are still just stuck 3%-3.5% below this yr high on SPY and QQQQ

Intraday

10:24am Still fighting this line

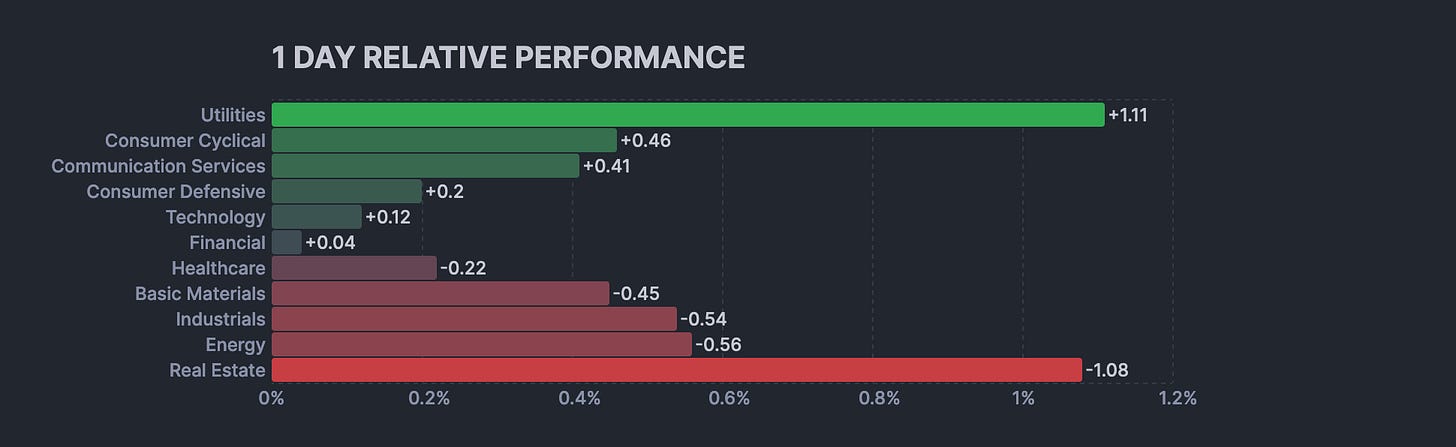

1:37pm Complexion…risk is being sold while they prop the markets through Mag 7.

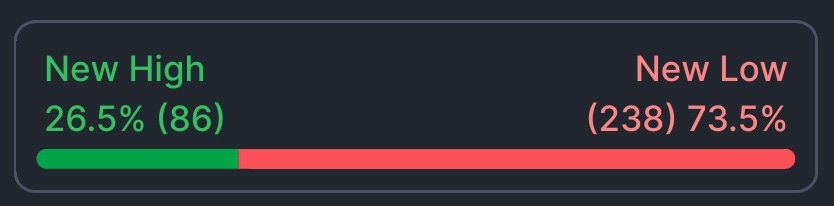

86 new highs vs 238 new lows

Breadth and Breadth volume.

Breadth

95 new highs

308 new lows

36% advancing 58% declining

71% below 50 day ma

Stuck out

Just some macro signs to be weary of

Econ sensitive stocks all rolling over

Industrial, construction, housing, housing related.

Examples

United Rentals

Parker Hannifin

Builders First Source

Retail group is weak

CA unemployment is picking up. Now 4.6%

Auto loans outstanding 1.5 trillion, a record

Avg home is 3x salary during great depression vs today at 8X

Debt to income ratio for home buyers hit 40%. 1st time in history. In 2008 it was 39%

Breadth is horrible

Megacaps are holding up the world again.

Amazon new yearly highs today

Adobe reports thu.

Strong

AMZN

Weak

NFLX

SG

ZG

HOV

EXTR

ROKU

CVNA

DAL

CROX

AFRM

What to watch

PPI Thu

Watch the mag 7

Watch yields

Economic data

Share this post