Podcast Available on

Spotify | Apple Podcast | Amazon Music

Follow on Substack Notes

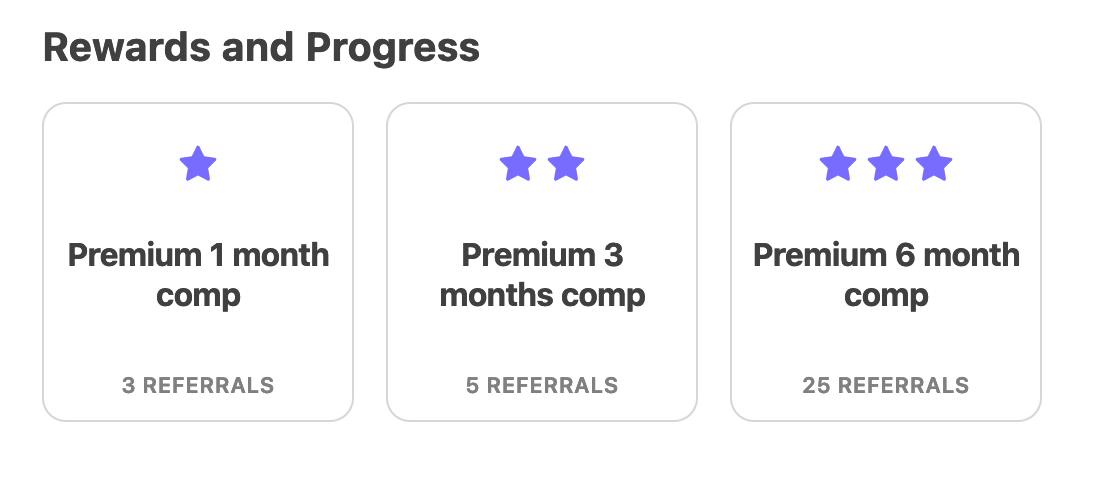

Referral Program for existing Subscribers

When you use the “Refer a friend” link below or the “Share” button on any post, you’ll get credit for any new subscribers. Here is the link you can copy and paste into any email, text or social media platform:

Once I launch a paywall, your referral credits earned will be retroactive immediately

Show Notes

Summary of the day

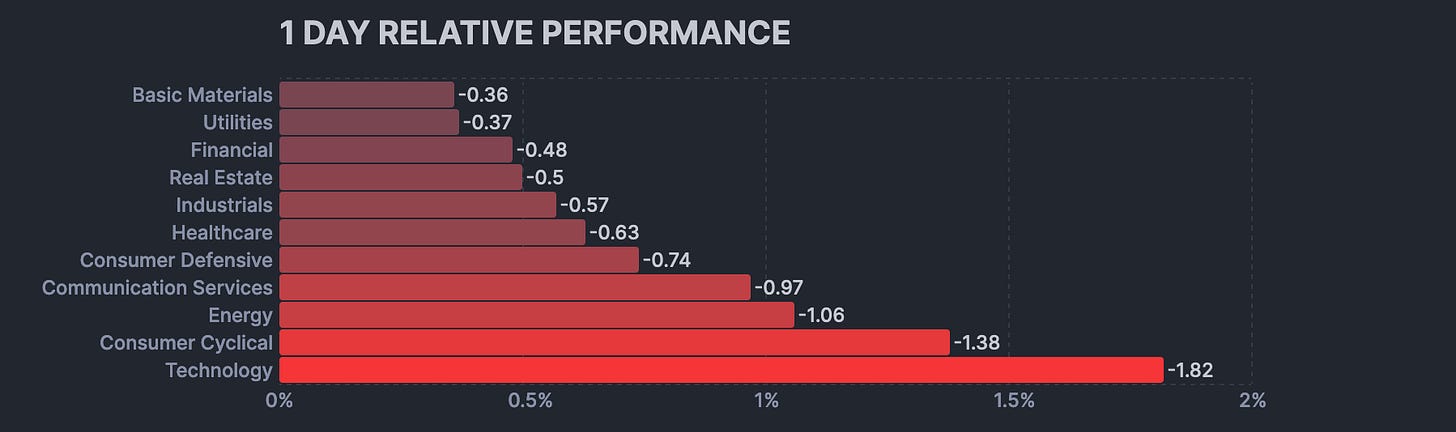

Forget a follow through day after a bullish Thursday. This was a massacre. So Wall St seems to have waited for both the CPI and PPI data to be digested and the masses to step back into the waters on Thursday with nothing but sunshine, cocktails and sun cabanas. Only to release their tiger sharks on Friday.

UAW went on strike strategically hitting the U.S. car makers in their most profitable factory locations. The workers are saying that since the bailouts of the automakers during the great financial crisis, they took concessions to help the auto co’s survive. And that since 2008, the auto companies bounced back but have not paid their workers and have left them in 2008 conditions. The workers are asking for more wages, no tiered ramp up on wages, and a 4 day work week.

The car companies are claiming if they give them what they want, they will go bankrupt. The workers are claiming if they get what they want the car companies would still make billions.

Then the backdrop is that this is a sign that workers are facing massive inflation. If the UAW wins, other unions and employees in general will continue to push for higher wages and less work in other industries.

So the narrative from government and the Fed saying that Inflation is not bad, is a lie. You must know and feel this in your own individual lives.

Just look at Crude Oil, it looks like it has a date with $160!!!

The 10 year yield is about to break thru to new highs.

We are only 8% away from lifetime highs. While the market is on wobbly ground, there still remains a chance at headline shock both up or down. Seasonality for end of yr is usually bullish. And 2024 is election yr. Watch yields, mag 7, interest rate sensitive sectors. Exciting and tumultuous week ahead!

Breadth

130 new highs

325 new lows

27% advancing 68% declining

69% below 50 day ma

Stuck out

$SMH if this breaks it will be headed to test the 200 day or overshoot and test 120

Strong

Gold and precious metals

Volatility

Yields

Weak

NVDA slices below 50 day, down 3.69%

CVNA -6.55%

BZH -6.20%

ARM -4.47%

KBH -4.25%

ADBE - 4.21%

KRUS -3.80%

TOL -3.5%

HOV -3.11%

SNPS -3.05%

AI -3.05%

SMH -3.03%

CROX -3.01%

I can go on and on and ON

What to watch

Sep 20 Wednesday 2pm NY Rate decision

Share this post