Financial Freedom is not free, but the pursuit is worth the treasure. Building a community with that goal. Let's go get it!

Available on Spotify | iTunes | Amazon Music

Twitter: nyugradsubstack

Referral program for existing Subscribers

Show Notes

Housekeeping. No podcast episode covering Thu and Fri sessions. Taking a long weekend.

Will resume covering Monday Aug 14 session releasing Tue Morning.

I will be active sharing analysis on Substack Notes and Twitter as much as I can.

Breadth

181 New Highs

216 New lows

55% advancing

40% declining

Every Sector is green

At 11:55am breadth was weaking

Rotation into dow 30 was evident

Selling of risk was also evident

the 10 yr closed at 4.1% and remains strong

30 yr mortgage very high 7.25%

While risk shares looked like it would lag behind the DOW 30 heavily, in the afternoon buying came in and the $VIX got whacked.

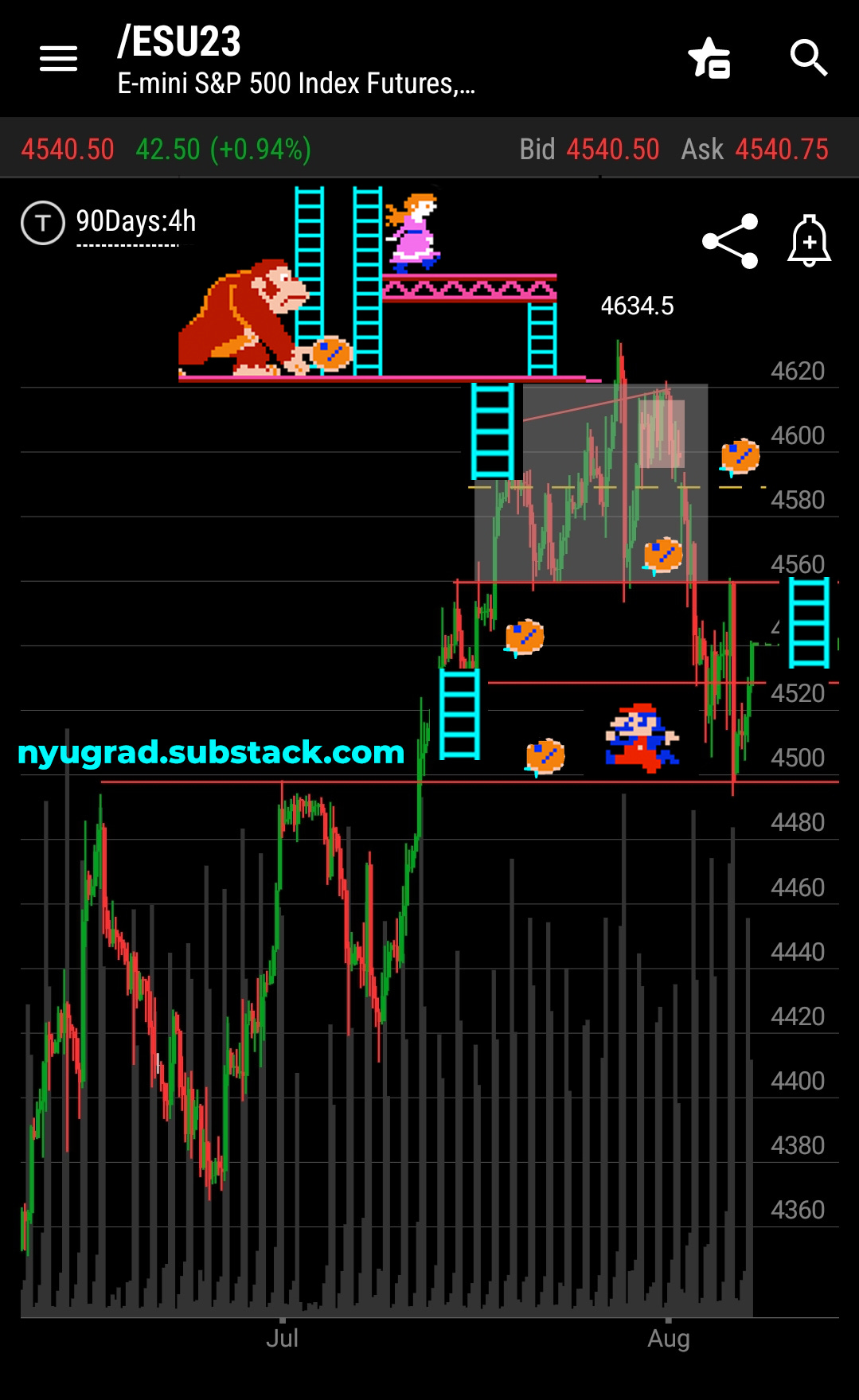

What Stuck out

Vanguard Funds in my 401k

I posted this morning “Your fees to Wall Street are wasted”

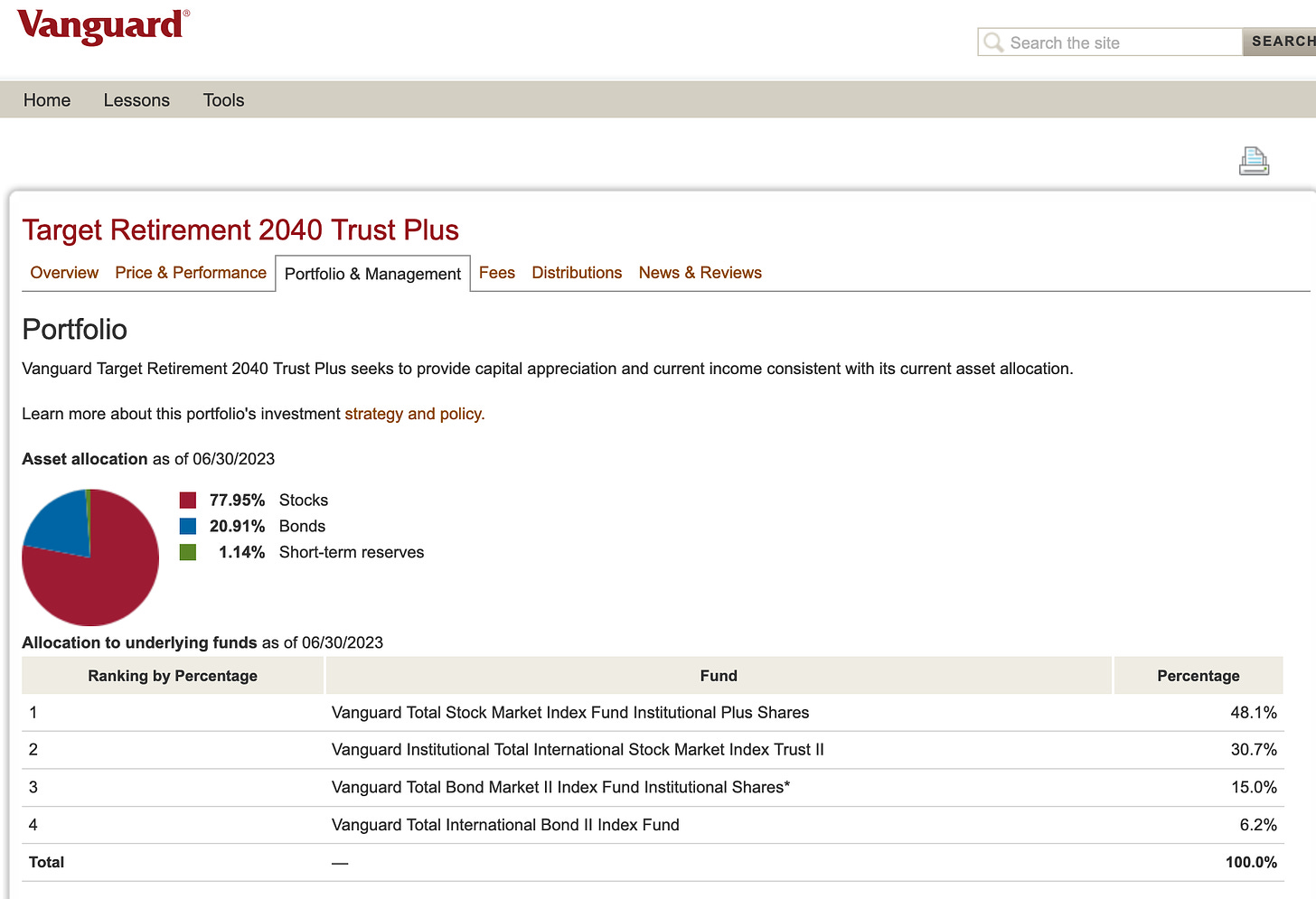

Take a look at this. I logged into my 401k plan via Vanguard. I looked at one of the middle of the road performing funds. All it has is a collection of other Vanguard funds. Both are managed by different fund managers! Talk about double dipping. And there is nothing illegal about this.

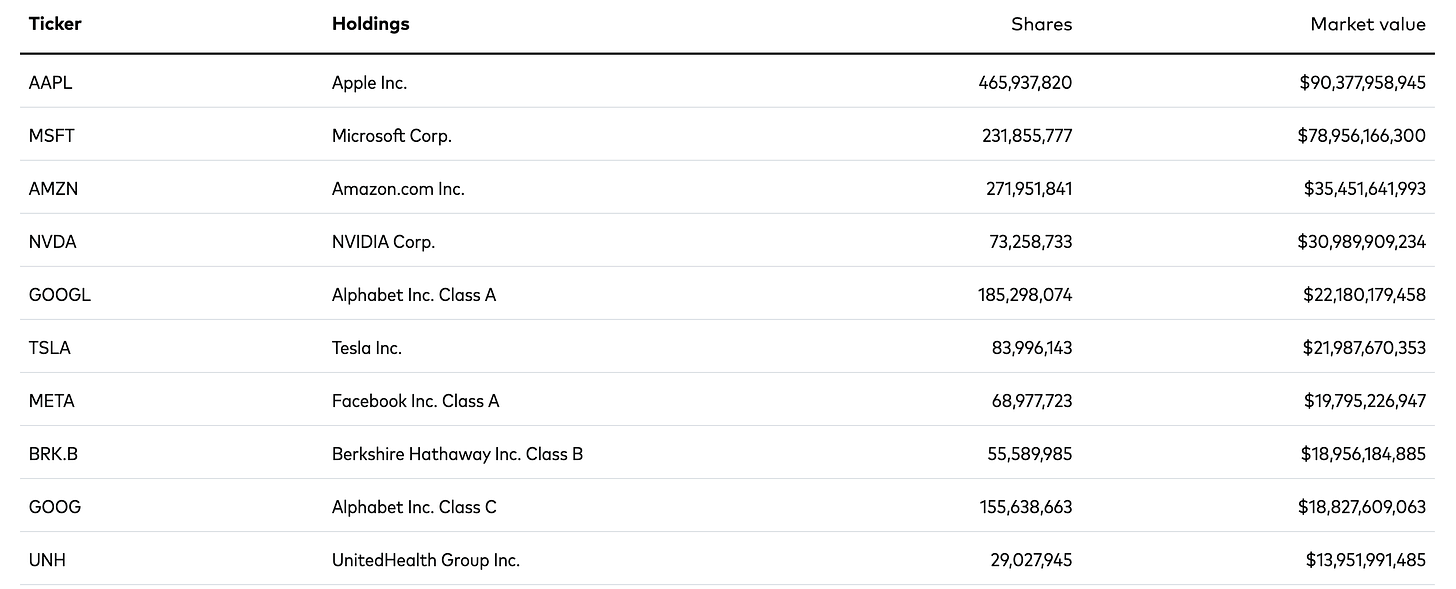

So what isthe composition of the first fund within this fund? The Magnificent 7!

And investors are paying fees to at minimum, 4 CFAs/fund managers! Must be a very nice lifestyle!

My friend and mentor, Bill Cara reported on this many times and taught many of his mentees why it is so important to know the real battlefield before once can succeed in the game of stocks and speculation.

Here is Bill’s recollection of late 1990s…

In 1997 or 1998, the Executive Director of the Ontario Securities Commission asked me to be the public’s sole representative in Canada’s final hearing of all securities regulators before they set policy regarding electronic trading. He also asked my opinion of the new Fund of Funds in that meeting.

I opined that it was double-dipping and would become common among friends in the investment management industry; hence it should be banned.

We don’t give enough credit to our regulators. They mean well and work hard. But, in the end, Wall Street gets what Wall Street wants.

It’s up to us to fight back by exposing our concerns as you have today.

Here from my upcoming book, The Maverick Investor, is the start of Chapter 2:

Understanding the Adversary and Focusing on What We Must Do.

Investors share a common goal: to achieve wealth accumulation and financial freedom through securities trading. However, in the vast and complex world of financial markets, not all participants have the same interests.

Standing opposite independent investors are the formidable sell-side – an entity wielding immense power and influence that directly impacts our financial independence and wealth. Understanding this adversary is crucial for navigating the treacherous waters of the market.

The sell-side encompasses diverse entities, from giants like Humongous Bank & Broker (HB&B) of Wall Street to the agents of misinformation found in online and broadcast media. Recognizing and explicitly defining their role and tactics within the financial landscape is the first step in gaining an edge.

To comprehend the battlefield, we must understand the battleground itself – a space to the right of your left ear and the left of your right ear – the center of gravity where critical financial decisions are made. From this vantage point, we can unravel the sell-side’s strategy and identify the ways, ends, and means they employ to exert control over independent investors like us.

Rather than viewing the sell-side as interminable boogeymen, a more productive approach is to assess their capabilities, needs, and vulnerabilities. While we can’t entirely shut them out, we can become adept at discerning the kernels of truth amidst the chaff in their words and actions. We can submit our complaints to securities regulators, whose job is to protect our rights and interests.

Strong

Everything into the close

Weak

Vix

What to watch

CPI Thursday

Treasury budget Thursday

PPI Friday

Share this post