Retiring soon and not sure what to do with your 401K? Start here 👇

Bill Cara Maverick Investors Handbook & program

According to the U.S. Census Bureau's population projections, about 12,000 people will turn 65 every day in the next year. That's about 4.4 million in 2024. And by 2030, all boomers — those born from 1946 through 1964 — will be 65 or older.

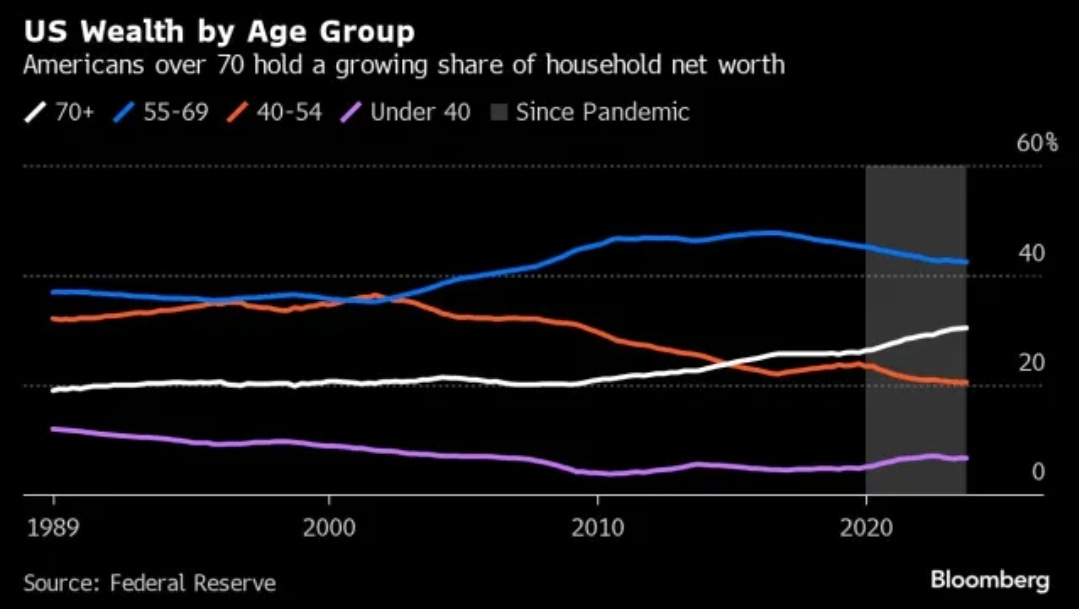

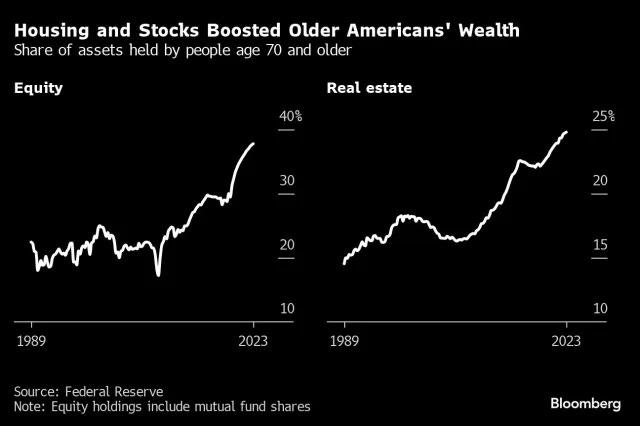

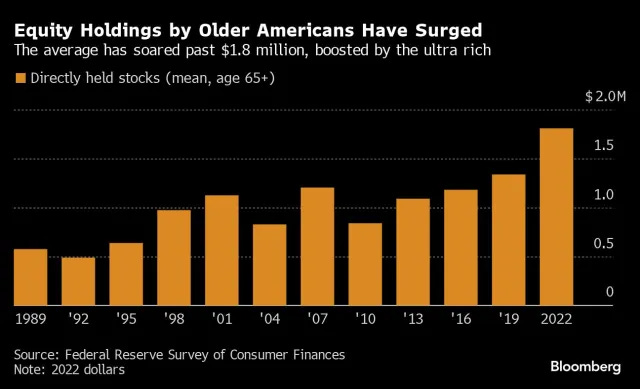

Americans over 70 yrs old hold more than 30% of the Country’s wealth!

That’s a lot of money to be managed in retirement. I guarantee you that brokerages and Financial Advisors/CFPs will be knocking on your door and inbox, if they haven’t begun to already. Your existing advisor is chomping at the bit to get all of it!

But wait. You are retired. Your kids have their own kids. Why let someone else profit from your hard saved money. You have all the time now to devote yourself.

Or you are 20 something and are lucky to be gainfully employed, less debt than your older friends and have nothing but time on your side. 40+ years of compounding power! But you want to avoid #FOMO #YOLO trading. You want to build wealth for yourself so you may enjoy life well before retirement age.

If you have the desire to learn and manage your own wealth, I believe you can do it. More importantly my mentor Bill Cara believes you can do it. And he has written a book and is launching a program to help you build and manage your own portfolio. It is time to become a Maverick Investor!

Excerpt

“The Maverick Investor's Handbook transcends audiences. It's not just for

students and novices but also for investors and retirees. Retirees have a

unique chance to become financially literate and pass on this life-skill

knowledge. You bestow an invaluable gift by teaching the next generations

about the stock market and financial independence the Maverick way.”

In the coming new year I plan to add a section to the Substack called “Maverick Investing.”

Recognizing the Foe: Wall Street isn't on our side. The promoted investment products and ETFs aren't "opportunities" but hidden risks they want us to take. Besides, building wealth is a serious business, not entertainment.

Divergent Interests: While seeking financial freedom, the market is a complex stage with diverse players. The formidable sell-side directly impacts our autonomy and wealth. Understanding different motivations is key.

Defining the Sell-Side: Ranging from Wall Street giants to online media, the sell-side exerts substantial influence. To outmaneuver them, understand their strategies and tactics, as they excel at influencing decisions.

The independent investors of the West have succumbed to the media onslaught from their governments, Wall Street, central bankers, and WEF globalists. Our people have become sheeple, ready to be sheared of our wealth.

When will we learn that ETFs are their Border Collies? If we stop trading their ETFs, we restrict their ability to manage the herd. If we invest only in quality companies based on asset valuations and revenue, cash flow, and earnings growth, we win. It’s only a matter of time.

Here is a post from July 2023 showcasing the elite managers of Wall St are nothing special. Your average US Mutual Fund performed badly last week. -Bill Cara

Over the long term, 98.6% of all actively managed domestic US equity funds in every major category and 99.8% of all large-cap funds, under performed the S&P 500 Equal Weight Index.

Based on 20-year total returns in USD (per S&P Dow Jones Indices LLC, CRSP, data as of Jan. 31, 2023), the performance of the major funds:

S&P 500 Equal Weight Index (Annual Return = 11.48%)

S&P 500 Growth (Annual Return = 10.88%)

S&P MidCap 400 (Annual Return = 10.84%)

S&P SmallCap 600 (Annual Return = 10.67%)

S&P 500 (Annual Return = 10.29%)

S&P 500 Value (Annual Return = 9.33%)

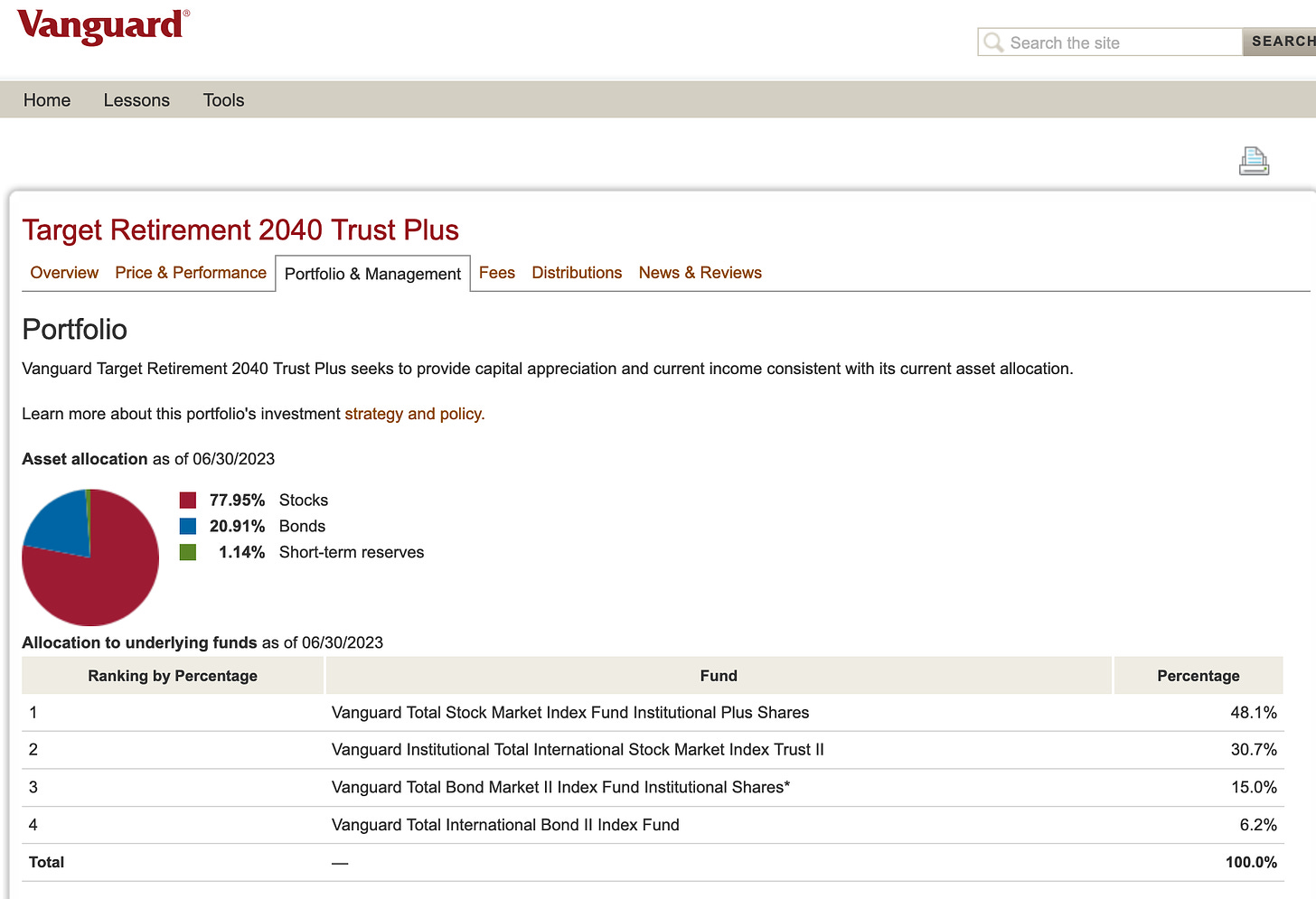

Take a look at this. I logged into my 401k plan via Vanguard. I looked at one of the middle of the road performing funds. All it has is a collection of other Vanguard funds. Both are managed by different fund managers! Talk about double dipping. And there is nothing illegal about this.

Target Retirement 2040 Trust Plus up 13% YTD

https://investor.vanguard.com/mutual-funds/profile/pe/portfolio/1657

Investment Manager Biographies

Michael R. Roach, CFA

Portfolio manager.

Advised the trust since 2023.

Worked in investment management since 2000.

B.S., Bloomsburg University of Pennsylvania.

M.S., Drexel University.

So what is in the top fund within the above retirement fund?

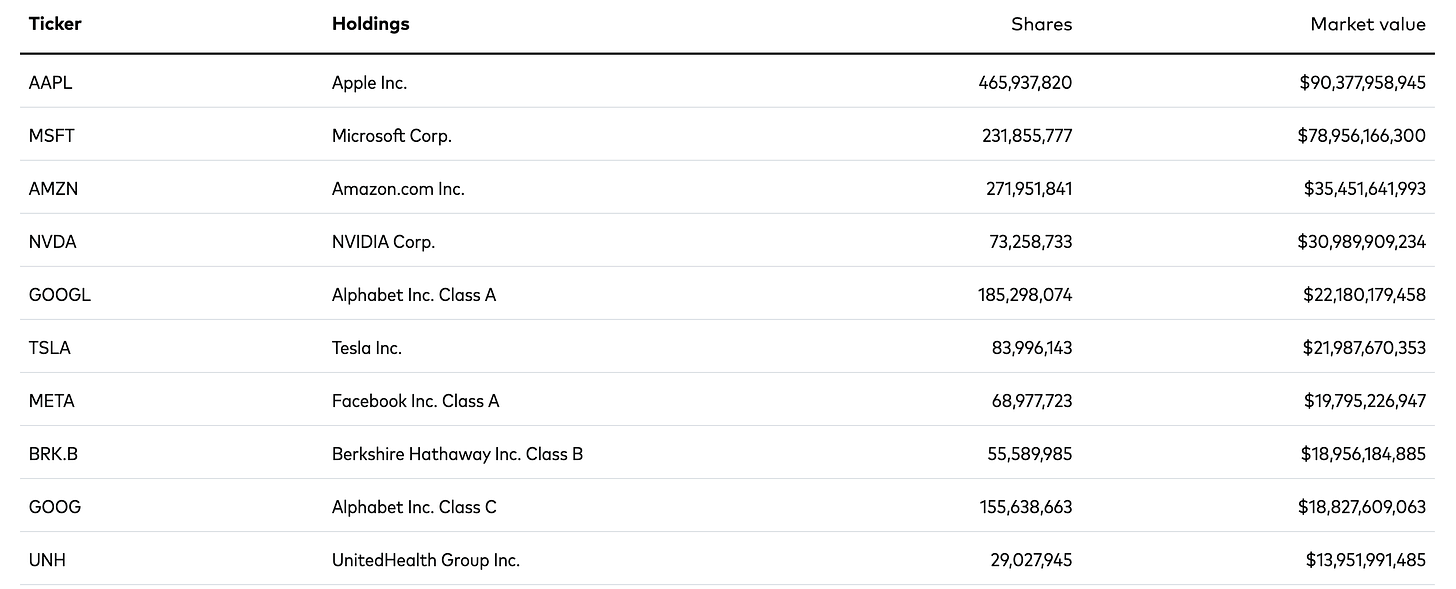

VSMPX? The Magnificent 7

And this Vanguard fund is managed by no less than three managers!

Gerard C. O'Reilly

Principal,

Portfolio manager.

Advised the fund since 1994.

Worked in investment management since 1992.

B.S., Villanova University.

Walter Nejman

Portfolio manager.

Advised the fund since 2016.

Worked in investment management since 2008.

B.A., Arcadia University.

M.B.A., Villanova University.

Michelle Louie

CFA,

Portfolio manager.

Advised the fund since 2023.

Worked in investment management since 2011.

B.S., The American University.

M.B.A., Georgia Institute of Technology.

Their lifestyles thank you!

The 1st book “Maverick Investor Handbook,” is only $18.95 as of Feb 29, 2024. Bill will also be releasing quarterly updates to the series on the specific companies noted in the Maverick program for a similar price. This is a lifework of learning from a professional who has over 40 yrs in the industry and knows all of the games Wall St plays to win against us.

You cannot afford not to educate yourself! And for what? The expense of $18.95 USD and a weekend read?

I’ll tell you what. If you are a paid member to my Substack and you purchase the Maverick Investors Handbook at retail, I will partially refund your membership for $3.79 one time (20% off the book) if the cost is an issue. All you have to do is email me a screenshot or photo of page 99 in the book as proof of your purchase.

*I am not being paid to promote the book. I genuinely believe people can benefit.

If you enjoyed this content please like, subscribe and share. Otherwise you might be sentenced to work past your retirement years!