“All Stocks are sold” - Bill Cara

Premium Episode 27 min

Free preview 15 min

Once I saw the broad market action for the past few sessions, I knew AMZN earnings wouldn’t matter.

Wednesday the entire market will either recover most of what we lost today or continue the selloff, after Jerome Powell and FOMC.

What does that quote mean? All Stocks are Sold?

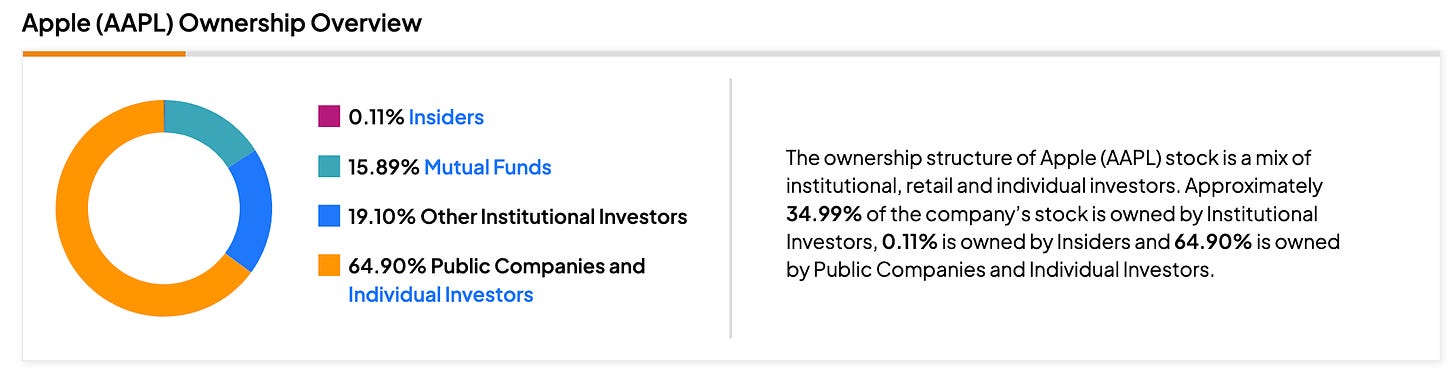

The last time I reported on “Apple the most dangerous stock in the world,” 535 ETFs held AAPL stock. 291 ETFs have Apple Inc. within its Top 15 holdings. That was Dec, 2022.

Today? Are you sitting down? 1,004! ETFs held AAPL stock, and 351 ETFs have Apple within its Top 15 holdings.

Source: Tipranks and ETFDB

Now expand to the other Mag 6. Let me help your imagination…

How do the Sell Side, Insiders, friends and family all sell before the riffraff? You tell grand stories! You sell them grand stories! The greatest stories ever sold!

Soft landing

No landing

Perfect Deleveraging

6 cuts on the dot plot

AI

3% unemployment

Strong Consumer

Cash on the sidelines

Announce Dividends

Announce BUYBACKS!

Say AI 90 times on your earnings call

Say NVDA on your earnings call

Announce a stock split

Announce layoffs and more layoffs

Say lower rate of inflation

Strong banks

This time is different

How are those earnings pops doing?

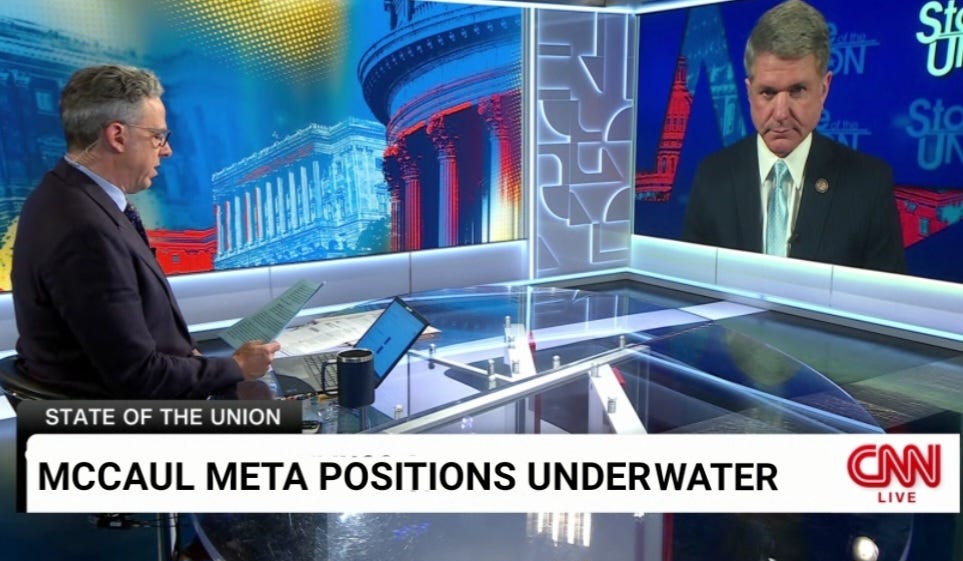

META (Sorry McCaul)

Still down big from recent earnings as well as the #tiktokban pump and dump. But has also lost almost all of the previous earnings rally from 2023, when they announced (Layoffs, Dividends, AI, and BUYBACKS!) Look at that Island Reversal pattern!

GOOGL lost 66% of the pop already

MSFT is now below the earnings pop

AMZN (as of 5PM ET after earnings) Nothing burger

TSLA lost 60% of the China pop

AAPL - TBD

Now do you see the pattern?

Podcast Available on Spotify | Apple | Amazon

Follow me on Substack Notes

Whether you subscribe for free or paid, you will gain value and ability over time to see stock market price movement in a way Wall St does not want you to see.

At the very least, improve your own education so you can grade your financial advisors homework and performance!

Read testimonials from paying members who are benefiting by learning my methodology and acting on it themselves, to improve their own management of their 401k, IRA and trading.

All Testimonials can be found here.

Excerpts below 👇

“Honesty in a sea of deception is of great value” - Ralph (Paying Subscriber)

“I signed up for premium after your '4 kisses' podcast last week. Today, already,on my first 'premium' day , I learned technique that's easily worth the full year's payment. Thank you for what you do.” - M. (Paying Subscriber)

“I like your in-depth analyses of the markets as well as pointing out what might lurk underneath that could rise up to bite us” - Sorell (Paying Subscriber)

“Your Wrap on the markets every day keeps me focused and grounded” - Lj (Paying Subscriber)

"I want to learn how to read the market for longer term trades as opposed to what Wall Street wants me to do” G.M (Paying Subscriber)

"I like your objective view on the markets” Ron P (Paying Subscriber)

"Good info. Succinct and relevant. Very good calls this month.” Andy J. (Paying Subscriber)

‘Didn’t realize how good the Premium content was!” Giles D (Paying Subscriber)

“Really enjoying your thoughts and analysis!” Steve C (Paying Subscriber)