Premium episode 21 min

Free Preview 13 min

Testimonials Page is fixed

Thanks F.B for the email

Hi NYUGrad!

I hope you are doing fine!

I got your podcast/email download right before taking off on a flight to Asia on Saturday, and was very happy to have it as the first listening of the trip.

Thank you very much for the very useful updates on Gold stocks and the overall market.

Best wishes,

F.B (Paying Subscriber)

Binge NYUGrad is live

New resource I want to share with Free members

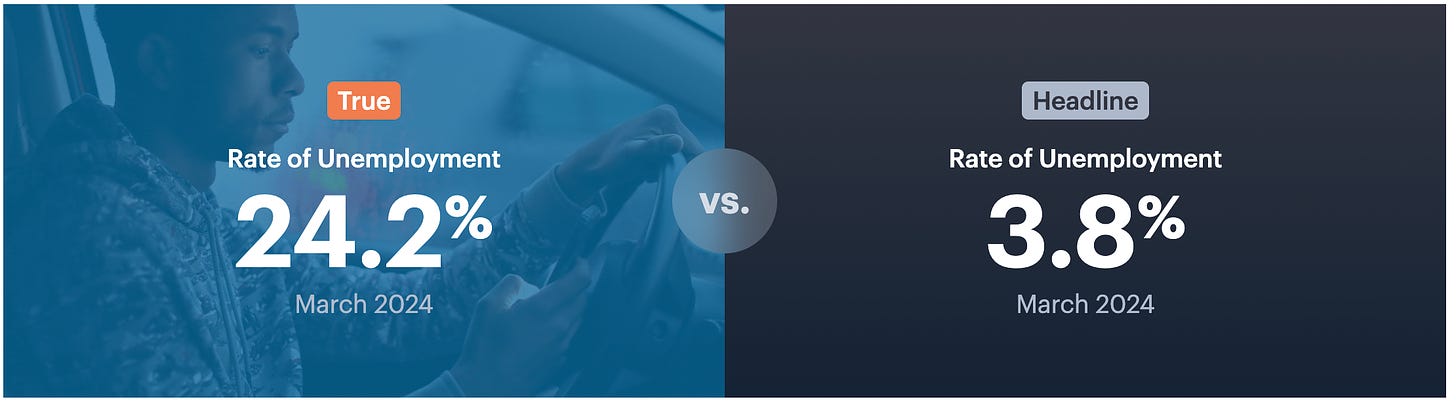

Tracks the percentage of the U.S. labor force that does not have a full-time job (35+ hours a week) but wants one, has no job, or does not earn a living wage, conservatively pegged at $25,000 annually before taxes.

Some highlights by time

3pm Treasury Quarterly Refunding announcement caused that selling. They need to borrow moaaAAARRRR!!!!!

During the April – June 2024 quarter, Treasury expects to borrow $243 billion in privately-held net marketable debt, assuming an end-of-June cash balance of $750 billion.[2] The borrowing estimate is $41 billion higher than announced in January 2024, largely due to lower cash receipts, partially offset by a higher beginning of quarter cash balance.[3]

https://home.treasury.gov/news/press-releases/jy2304

2:30pm

$SPY 21m shares traded vs 71m avg as of 2:30pm (70% shy). Everyone go home early and hug your family

GOOGL losing a lot of the earnings pop

MSFT lost all of the earnings pop

Yen carry trade is more important than all of this. 20 Trillion +

One of the most popular trades in foreign-exchange markets is losing its luster as the Bank of Japan signals the end of its negative interest rate policy.

The appeal of using borrowed yen to buy securities denominated in higher-yielding currencies, known as a carry trade, is in flux after remarks this week from the BOJ’s Hajime Takata hinted at a potential policy change. That’s giving pause to money managers, especially now that leveraged funds have boosted their bets against the yen.

Understand the inter relationships

Yen crashed Sunday

this is bad for Japanese population as they are an island and need to import things

If usd rises as the currency pair should with yen falling, that is a head wind for the market. Higher rates. Lower stocks.

Yen begins to get propped up Monday am. USD begins to fall

Watch this dynamic. Is Japan finally going to allow the Yen to rise? You better book your trip to Japan before they do.

Podcast Available on Spotify | Apple | Amazon

Follow me on Substack Notes

Whether you subscribe for free or paid, you will gain value and ability over time to see stock market price movement in a way Wall St does not want you to see.

At the very least, improve your own education so you can grade your financial advisors homework and performance!

Read testimonials from paying members who are benefiting by learning my methodology and acting on it themselves, to improve their own management of their 401k, IRA and trading.

All Testimonials can be found here.

Excerpts below 👇

“Honesty in a sea of deception is of great value” - Ralph (Paying Subscriber)

“I signed up for premium after your '4 kisses' podcast last week. Today, already,on my first 'premium' day , I learned technique that's easily worth the full year's payment. Thank you for what you do.” - M. (Paying Subscriber)

“I like your in-depth analyses of the markets as well as pointing out what might lurk underneath that could rise up to bite us” - Sorell (Paying Subscriber)

“Your Wrap on the markets every day keeps me focused and grounded” - Lj (Paying Subscriber)

"I want to learn how to read the market for longer term trades as opposed to what Wall Street wants me to do” G.M (Paying Subscriber)

"I like your objective view on the markets” Ron P (Paying Subscriber)

"Good info. Succinct and relevant. Very good calls this month.” Andy J. (Paying Subscriber)

‘Didn’t realize how good the Premium content was!” Giles D (Paying Subscriber)

“Really enjoying your thoughts and analysis!” Steve C (Paying Subscriber)