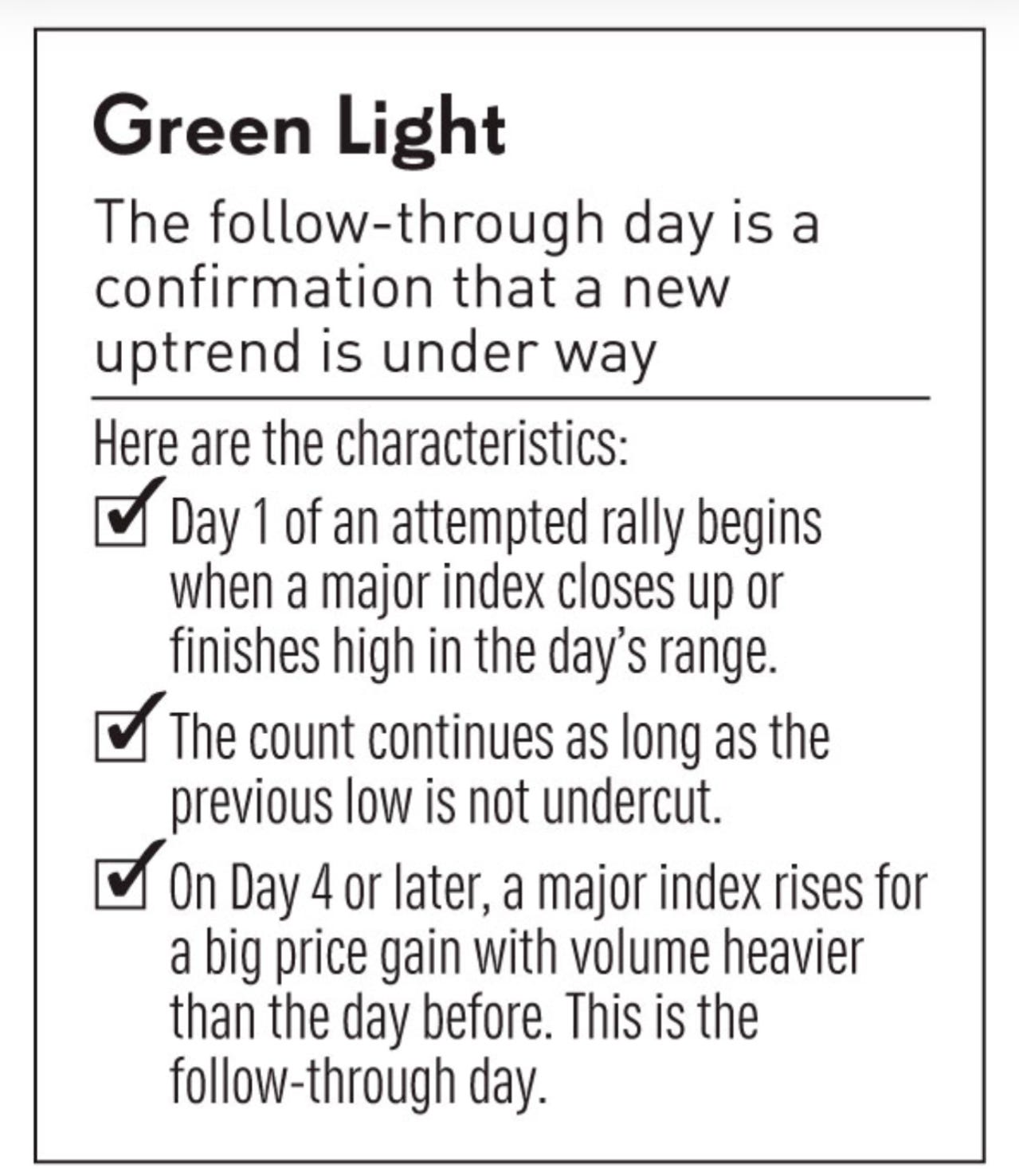

First thing is first. We had a follow through day on Wednesday and that means Monday’s low should hold for a little while.

Every Bull market started with a follow through day, 100%

However not every follow through day leads to a bull market. Got it?

It is like saying everyone who owns a Lambo is a douchebag, but not every douchebag owns a Lambo. My friends with exotic cars will get a kick out of that one.

Bookmark this (IBD Defines Follow Through Day)

Trump is “optimistic” China will seek a deal with the U.S.

And the other side of the Pacific…

In a separate statement, the Commerce Ministry in China expressed, "Even if the U.S. continues to impose higher tariffs, it will no longer make economic sense and will become a joke in the history of the world economy."

China raises their Tariffs on US goods (if there are any) from 84% to 125%.

Tariff wars are also now transitioning into currency wars, everyone for themselves.

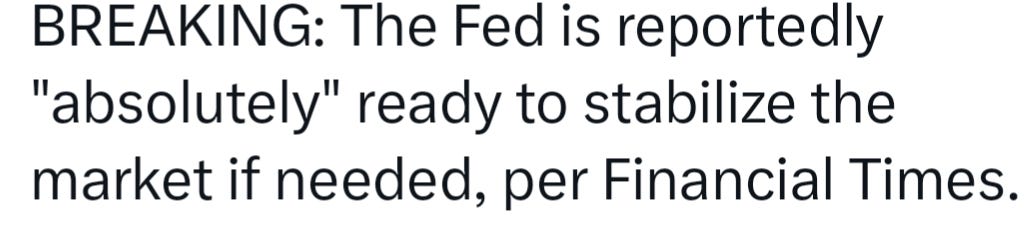

I suspect China will sell US Treasuries to weaken the US Dollar stance. Even Japan is slowing their purchases. Not purchasing is the same as selling, when America needs to continue to print to service it's debt and spending. FYI the US, the US taxpayer holds a significant portion of its own debt through government entities and the Federal Reserve. The Fed has approx 5T.

Japan and EU holds approx 1T each and China 750B. The simplified way to think about this is everyone agreed to buy US debt, funding American markets. US agreed to ship out our jobs and buy their goods.

That macro trade and contract is unwinding before our eyes.

If this continues, a hot war is likely next in a few years. USD falling is hyper inflationary. A slow down in economy then becomes a stag-flationary spiral leading to deflation.

If your boy(s) are going to be 18 in the next few yrs, we might see a global military draft.

Taiwan is probably shaking.

I coincidentally was shared this article written by

. Keep in mind I am not 100% sure if Mark Carney (Canada PM) in fact toured like Taylor Swift to coordinate a selling of US Treasuries with Japan and the EU. But as you can see, regardless of who sold, it is a reminder how connected the global economy is. Your television, your dinner tonight, our well being in America is partly funded by other nations purchasing our debt. A lot of it.And at the Fed. Let me translate

‘If someone sells US Treasuries, we will buy. If no one buys US Treasuries, we will buy.’

Free Preview: 15 min

Full Episode: 19 min

Please remember to ❤️

or the 🥷 will find you!

🎧 Podcast Available on all major platforms: Spotify | Apple | Amazon

👉 Recommended Chart Software at Slope Charts