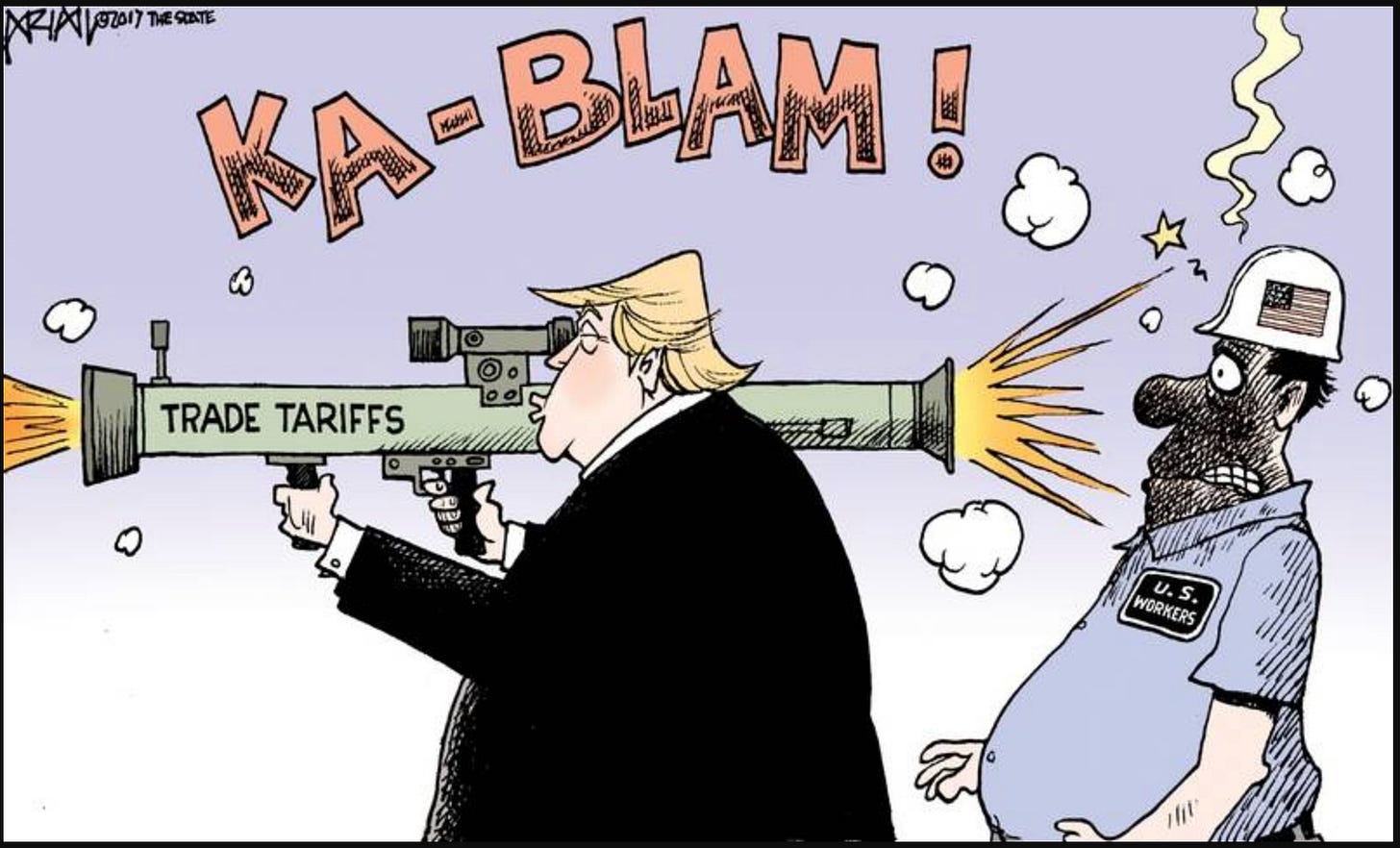

This is a very fluid global situation. By the time you read or listen to this, the tariff wars may be over or escalating. But I was very curious how Alphabet’s AI via NotebookLM would interpret the below sources.

Keep in mind the podcast is 100% AI Generated and can only be as objective as the parent company that trained it to be.

Enjoy the 15 min AI discussion.

Below are the sources and Briefing doc. Hope you enjoy the content and learn something new.

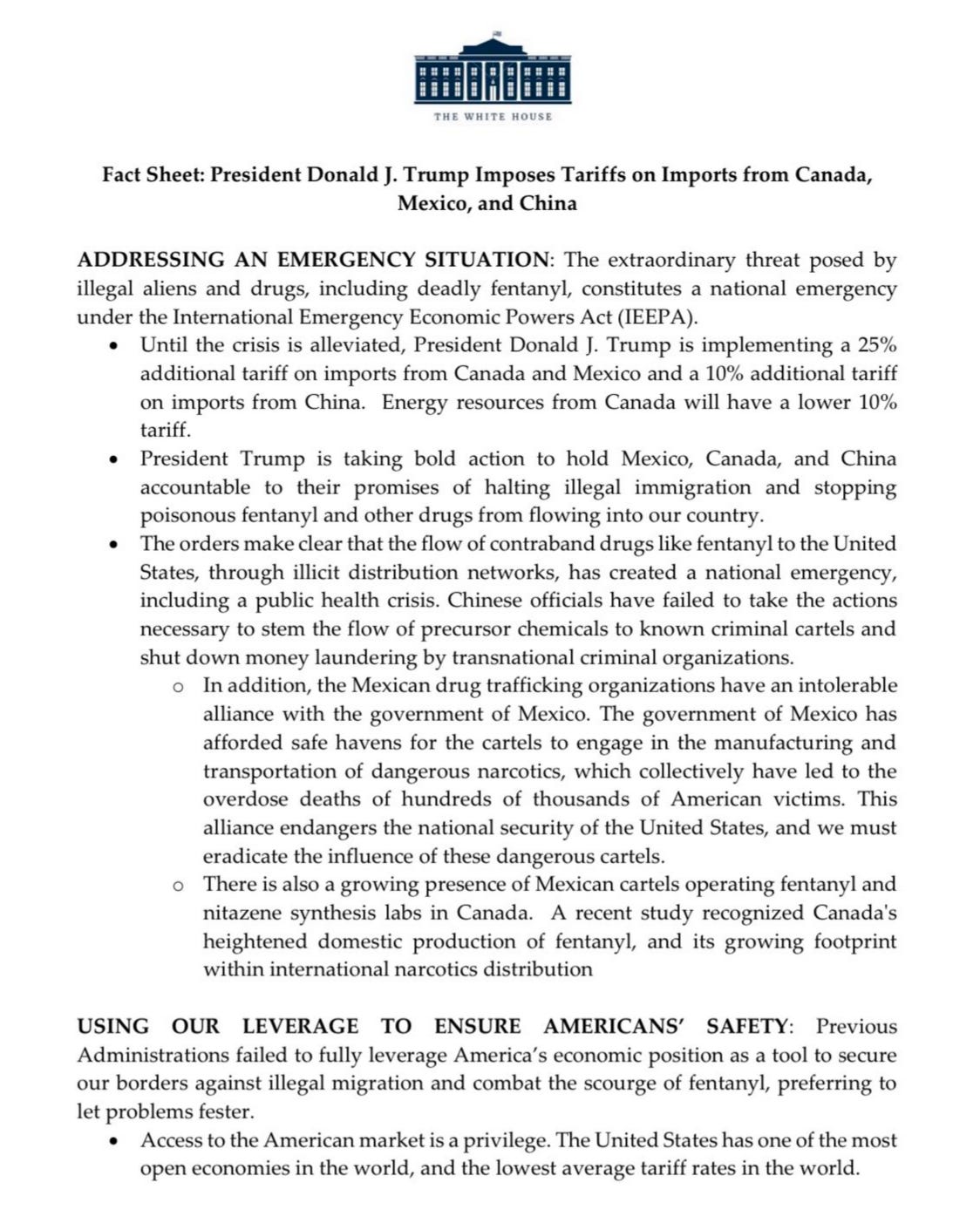

The White House Fact Sheet regarding the Tariffs on imports from Canada, Mexico and China.

Canada and Trudeau’s response

Lacy Hunt interview with

Ray Dalio and his work, “Changing World Order”

History of tariffs in the United States

https://en.wikipedia.org/wiki/History_of_tariffs_in_the_United_States

Briefing Document: Tariffs, Global Order, and Economic Cycles

Executive Summary:

This briefing synthesizes information from four sources, covering the history of US tariffs, current economic thinking on inflation and monetary policy, cyclical models of societal change, and recent trade tensions. The analysis reveals recurring themes:

Tariffs as a Tool: Throughout U.S. history, tariffs have been used for both revenue generation and protectionism, with significant impacts on economic and political landscapes.

Cyclical Patterns: Historical patterns suggest recurring cycles of economic expansion, conflict, and societal restructuring. These cycles impact global power structures and economic systems.

Interconnected Crises: There's a growing concern that financial, social, and geopolitical crises are converging, creating a complex and potentially destabilizing environment.

Global Trade Tensions: Current trade policies and geopolitical events indicate a shift toward protectionism and competition.

Source 1: "History of Tariffs in the United States - Wikipedia"

Main Themes:

Evolution of Tariffs: The U.S. has a long history of using tariffs, evolving from a primary source of revenue to a tool for protecting domestic industries and shaping trade relationships.

Protectionism vs. Free Trade: The debate between protectionism and free trade has been a central theme in U.S. economic policy. Notable figures like Alexander Hamilton and Henry Clay advocated for protectionism, while others, like Grover Cleveland, opposed it.

Tariffs and Political Parties: Tariffs have been a major point of contention between political parties. The Republican Party was long associated with high tariffs, while Democrats often pushed for lower rates.

Tariffs and Key Events: Major historical events like the Civil War and the Great Depression were closely linked to tariff policy, either as a cause, consequence, or a tool used to address the crisis.

Impact of Globalization: In the late 20th century, the U.S. shifted toward trade liberalization, culminating in agreements like NAFTA and the creation of the WTO, but this trend has recently come under scrutiny, leading to renewed focus on tariffs.

Key Ideas and Facts:

Early Reliance on Tariffs: In the early years of the republic, tariffs were the main source of revenue for the federal government. As late as 1835, tariffs made up 54.1% of the federal budget.

Hamilton's Infant Industry Argument: Alexander Hamilton argued that new industries need temporary protection, such as tariffs or import prohibitions, to develop. He believed this protection would ultimately lead to cheaper, higher-quality domestic production. He stated "once a "domestic manufacture has attained to perfection... it invariably becomes cheaper"

Lincoln and Tariffs: Abraham Lincoln believed a "protective tariff" was crucial for national greatness and prosperity. He said: "Give us a protective tariff and we will have the greatest nation on earth."

The Civil War and Tariffs: The tariff question was a major point of contention between the North and South, as the industrial North favored protection while the agricultural South opposed it.

The Smoot-Hawley Tariff: The Smoot-Hawley Tariff of 1930 is often cited as exacerbating the Great Depression. But some economists, like Peter Temin, argue that the negative economic impact of the tariff was small relative to other factors.

Recent Tariff Actions: Both the Trump and Biden administrations have used tariffs as a tool of trade policy, particularly with China. The Trump administration imposed tariffs on steel, aluminum, solar panels, washing machines, and many Chinese goods, while the Biden administration has also increased tariffs on Chinese imports, including solar cells, electric vehicle batteries, steel, and aluminum.

Smuggling: High tariffs have historically led to increased smuggling, leading to the creation of enforcement agencies like the U.S. Revenue Cutter Service (now part of the Coast Guard).

Quotes:

George Washington: "I use no porter or cheese in my family, but such as is made in America...of an excellent quality."

Henry Clay: "Equal and reciprocal free trade never has existed; [and] it never will exist."

Abraham Lincoln: "Give us a protective tariff and we will have the greatest nation on earth."

Grover Cleveland: "the exaction of more than [minimal taxes] is indefensible extortion and a culpable betrayal of American fairness and justice."

Source 2: "Lacy Hunt: It's Not Inflation –Thoughtful Money with Adam Taggart – Apple Podcasts"

Main Themes:

Inflationary pressures: The discussion centers on the causes of recent inflation with Lacy Hunt arguing it's primarily from supply-side issues not demand, which is important for monetary policy.

Monetary policy effects: The monetary policy of central banks such as the US Fed is discussed, especially interest rate hikes.

Key Ideas and Facts:

Supply-side issues: The podcast discusses supply chain shocks, labor supply, and war as causes for recent inflationary spikes.

Source 3: "Neil Howe: We May Suffer A Collision of Financial, Social & Geo-Political Crises All At Once"

Main Themes:

Fourth Turning Theory: Neil Howe discusses his cyclical theory of history which describes 4 phases in a cycle. We are in the 4th turning now, which is characterized by crisis and the collapse of old institutions.

Interconnected Crises: Howe suggests that financial, social, and geopolitical crises are likely to coincide, creating a very challenging environment.

Government Mobilization: In times of crisis, governments will mobilize and redistribute resources, potentially through a combination of higher taxes, debt issuance, and inflation. He says it is a "law of nature" that governments take wealth from everywhere during emergencies.

Leadership in Crisis: Strong leaders often emerge during crises. However, the specifics of who those leaders are is less important than the fact they will need to take strong actions to protect the government and the society.

Impact on Generations: Generational dynamics play a significant role in these cycles.

Fiscal Revolution: The interview hints at a coming "fiscal revolution" that requires a major change of how the government finances itself as well as its relation to its citizens.

Key Ideas and Facts:

Financial Repression: Howe anticipates "a higher rate of inflation combined with financial repression," where governments force people to hold low-interest bonds.

Government Growth: In the past, fourth turning events had an open field to work with. Governments were small and could grow without taking something away from anyone. This time, government is already large so it will need to displace other aspects of society to make its moves.

Veteran Benefits: Historically, governments provide benefits to veterans after a crisis. However, this has a lifespan, with prior veterans' benefits typically ending just before the next crisis emerges.

Public Trust in Leaders: While currently there is a great deal of public distrust, it is possible for leaders to again earn support during a crisis, citing George W. Bush's approval rating after 9/11.

Millennials: Millennials have a different attitude towards investing, with a focus on investing in large cap stocks that are less likely to fail.

Bailouts: Howe anticipates continued bailouts, but believes they will come with more stringent requirements regarding who wins and loses.

Hard Assets: Howe suggests avoiding long term nominal assets. He recommends things with intrinsic value such as commodities and precious metals. Also, things on the "real" side of the economy such as manufacturing and materials. He also mentions defense ETFs.

Quotes:

"I see a higher rate of inflation combined with financial repression as being virtually locked into the cards right now."

"once the survival of the regimes at stake... you're going to mobilize everybody and you're going to take wealth from everywhere."

"We need adversity to be strong."

Source 4: "Principles for Dealing with the Changing World Order by Ray Dalio"

Main Themes:

Cyclical Nature of History: Ray Dalio presents a cyclical view of history where world orders rise and fall over a long period of time, roughly 250 years.

Indicators of Power: Dalio defines the key metrics to evaluate the power of an empire: education, technology, global market competitiveness, economic output, share of world trade, military strength, financial center power, and currency strength.

Typical Empire Cycle: Dalio lays out a typical cycle: (1) strong education, innovation, and technology, leading to (2) global market competitiveness, followed by (3) reserve currency status, then (4) expansion and borrowing, leading to (5) bubbles, (6) overextension, (7) debt problems, followed by (8) revolution and transition to a new world order.

Reserve Currency Status: Having the world's reserve currency allows an empire to borrow more than other countries, which can lead to unsustainable debt.

Conflicts and Change: These transitions between world orders are often accompanied by great conflicts, as the leading powers don't decline without a fight.

US Decline: Dalio believes the United States is declining and China is rising.

Key Ideas and Facts:

Overlapping Cycles: Dalio highlights the overlapping nature of these cycles, and that these cycles have transition periods of 10-20 years with great conflict.

The Big Cycle: Dalio has identified the key phases in these cycles with his model which he calls the big cycle.

Financial Centers: The leading empires develop world-leading financial centers: Amsterdam, London, and New York. China is now developing its financial centers.

Money Printing: Governments facing debt problems will ultimately choose to print more money, devaluing the currency and raising inflation.

The US dollar's decline: The current cycle may have many of the hallmarks of an era that marks the end of its big cycle.

Quotes:

"The times ahead will be radically different from those that we've experienced in our lifetimes, though similar to many times before."

"The exorbitant privilege afforded by the empire's reserve currency leads borrowing to increase and the beginning of a financial bubble."

"The big sell off in dollars and dollar debt hasn't yet begun."

Source 5: "Read the transcript of Trudeau’s response to U.S. tariffs on Canada - National | Globalnews.ca"

Main Themes:

Canadian Response to U.S. Tariffs: This source highlights Canadian Prime Minister Justin Trudeau’s response to tariffs imposed by the U.S.

Importance of Partnership: Trudeau emphasized the importance of the economic, military, and security partnership between Canada and the U.S. and the importance of not “punishing” each other.

Canada’s Assets: He notes Canada’s critical minerals, reliable energy, democratic institutions, shared values, and natural resources.

Key Ideas and Facts:

Historical success of cooperation: Trudeau makes the point that both countries are stronger together and have a long history of successful cooperation.

Canada as a Necessary Partner: He highlights Canada as a necessary partner, and a better choice than "punishment" for building North American economies.

Quotes:

"Together, we’ve built the most successful economic, military and security partnership the world has ever seen. A relationship that has been the envy of the world."

"if President Trump wants to usher in a new golden age for the United States, the better path is to partner with Canada, not to punish us."

Cross-Source Analysis:

The Role of Tariffs: These sources collectively demonstrate that tariffs are a recurring tool in national economic strategies, yet they can also contribute to international conflicts and economic disruptions.

Cyclical History: The theories of Neil Howe and Ray Dalio, while using different frameworks, both show the cyclical nature of history, suggesting we're entering a period of great change and possible upheaval.

Convergence of Crises: The sources suggest that we face multiple, interconnected challenges, increasing instability in the political and economic realm.

Government Response: Both Howe and Dalio suggest governments respond to large crises by increasing government spending and involvement through fiscal and monetary policy. The historical data in the tariff analysis suggests governments have responded to past crises by raising tariffs.

Shifting Global Order: The convergence of all the elements discussed point to a potential change in the existing global order.

Implications:

This information suggests a need for careful consideration of economic policies, a proactive approach to managing risk, and recognition of the potential for significant changes in the global landscape. The current environment of rising trade tensions and shifting global powers makes understanding these cycles all the more important.

This briefing document provides a comprehensive overview of the interconnected themes and ideas presented in the given sources, useful for strategic planning and decision-making.

Disappointingly biased. If you only include comments and examples from one view point your are just pushing propaganda. Not worth my time to listen.

Ha ha same person far left or right is a brilliant observation. I do not know where to get unbiased LLM. So far my strategy is more of a “shotgun” blast of everything and trying to be aware that my own biases are an imperfect filter to determine what is truth. I primarily use chatGPT and Perplexity for LLM.

Just saying both of those are trained in California.

You may be surprised but I actually agree with you. Please point me to an LLM Model that I can use to add as a source for this. GROK only posts results on X and I can't use as a source.

Also keep in mind most of my sources are agnostic. @AdamTaggart is one of the most professional interviewers who tries to remain objective politically. Wikipedia is not 100% but please share a source that is. Help me improve vs pounding the table. I am middle when it comes to politics. I actually find anyone who is far left or far right, the same person but they don't realize it.

Bias and region of development would be a very interesting study of LLM. Although, Adam T. Is in CA and he does an admirable job of trying to keep his interviews unbiased. So it might be more based on the individual doing the “work” and not so much the region.

Interesting lady, the Trump and the idiot looking for his blackface make up.