Bill Cara has been a mentor of mine for a long time. I have to search my inbox to figure out how long but let’s just say the early 2000s. He has a very broad understanding of the market, their inter-relationships. He also is one of the very few minds who can switch from macro to micro, in a fashion that no one I know can do well. Meaning he understands how the machine works globally. But also can deep dive into fundamentals and or technical analysis.

His biggest trading asset by the way is his dogged determination to keep learning. So when he speaks or writes, I pay attention. I sift though the words and try to understand why he thinks that. Why he chose to write about that now?

Bill has been a market operator for over 40 years. A rarity today. So read what he has to say. Learn from it. Question it. Use it as a starting point for your own discovery of facts and hypothesis.

I have written about Bill many times. Below are a few examples:"

His post today is too important to simply bury in a link. So I have applied NotebooksLM to it and added the Market transparency post from March as a secondary source. So whether you like to consume content by reading or listening, I have you covered.

This is a free post so please share it with everyone you know that may enjoy it.

The Imminent threat of a market crash | Written By Bill Cara

December 4, 2024

Many years ago, the founder and CEO of one of North America’s leading advertising firms gave me advice I have never forgotten. He said clients multiplied their promotional budget right before bankruptcy in a final gasp effort to save themselves. Eventually, very few of them paid because they had later looted the company of remaining funds as they fled before the collapse.

It’s an interesting parallel to how markets work because, at its core, the market reflects human behavior. Our decisions are based on our hopes, fears, and sometimes wisdom.

That last line I took from page one of the book I am writing.

I bring this point up today because investors and investment managers have joined in an unsustainable burst of buying that a crash has always followed.

Unsustainable market performance

The S&P 500’s performance shows 1-month, 3-month, and 12-month gains of 5.8%, 9.6%, and 32.5%. The Nasdaq 100 shows 6.0%, 12.2%, and 32.6% gains.

Insider Selling

While investors are buying prices at such a phenomenal clip, insider buys are extremely low, and their selling is happening in amounts and at rates not seen in decades and maybe in history.

Corporate bankruptcies

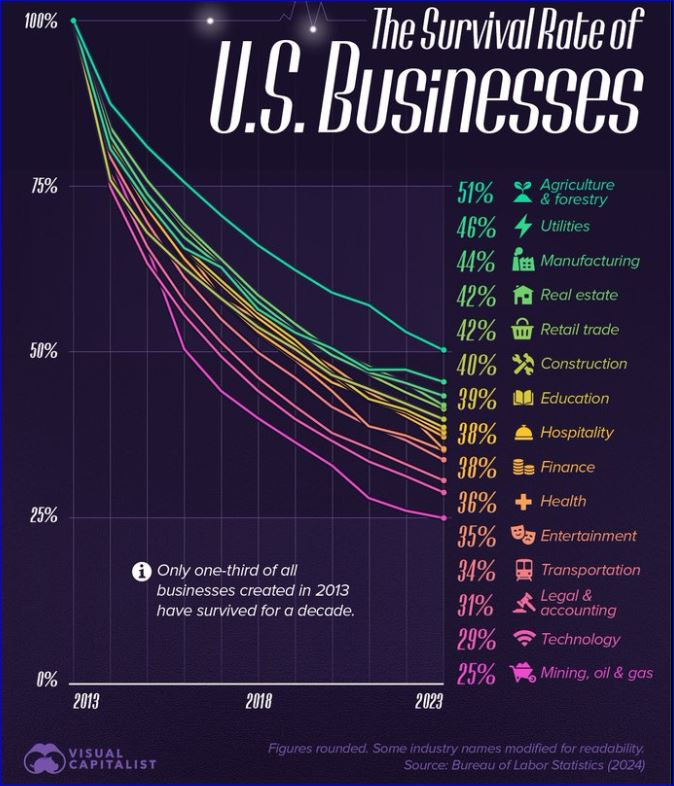

Business failures are at extreme levels.

This Visual Capitalist graphic shows that one-third of all businesses created in 2013 did not survive through 2023.

Is the market at a top or a bottom?

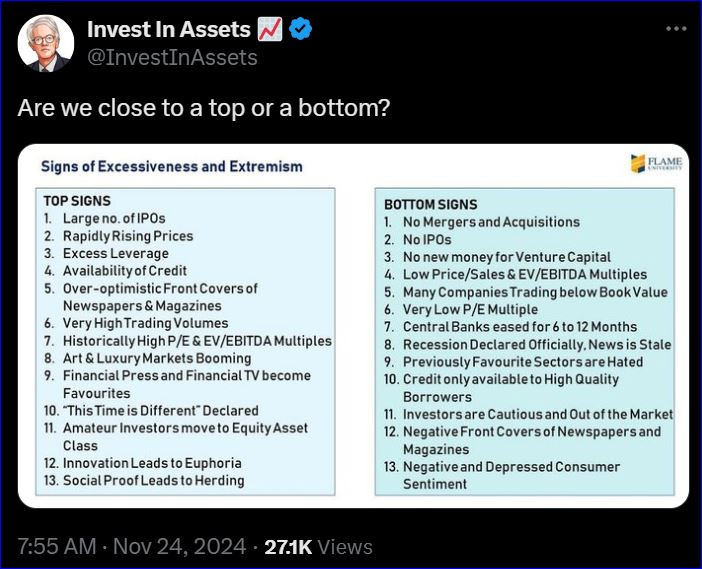

Peter Lynch is a legendary investor with a track record very few fund managers have ever beaten.

In the following graphic of an X/Twitter post, he asked on Nov 24 whether the market is close to a top or bottom. Because all 13 of his market top indicators are checked off, his top vs. bottom signs should be a clarion call.

Is the market fearful or greedy?

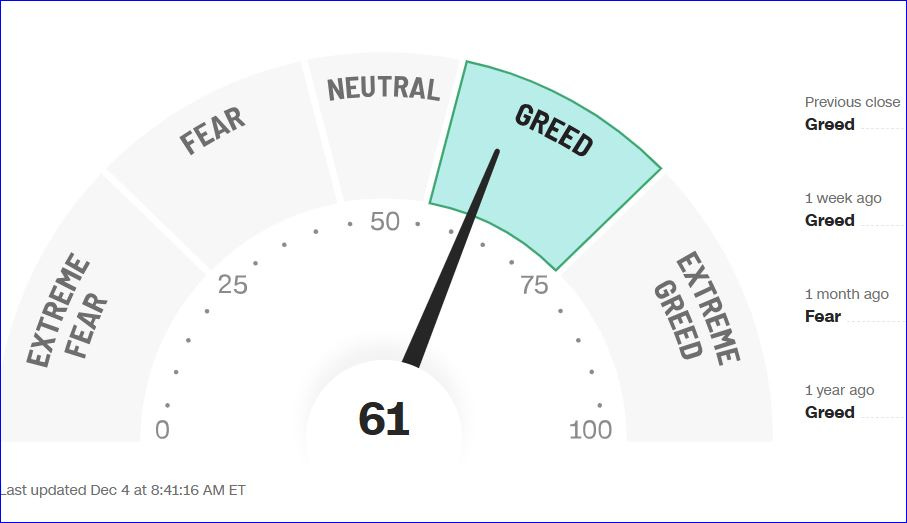

As Warren Buffet says: “be fearful when others are greedy, and greedy when others are fearful.”

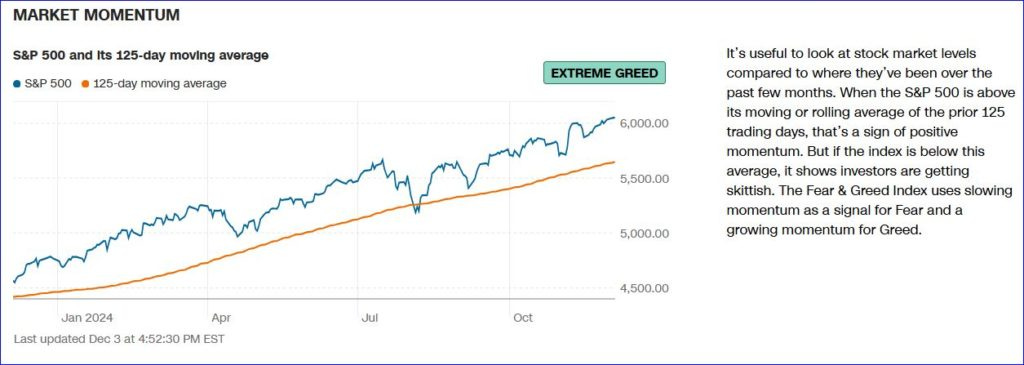

CNN’s Fear and Greed Index gauges investor sentiment. Today, and most days recently, the index shows Greed.

The Market Momentum and Put and Call Options metrics show Extreme Greed.

Is the Fed raising or cutting rates?

Throughout 2024, I have warned that the first Fed policy rate cut would sow the seeds of the next crash. That happened in September. Since then, a growing percentage of S&P 500 stocks have encountered pullbacks. The Fed cuts rates in troubled economic times, not when the future is bright.

On Dec 1, John Williams, the New York Fed President, whose position is more important than the Fed chairman’s, made a telling comment. He opined that the Fed “will likely need to lower rates further to move policy to a neutral stance now that risks to inflation and employment have become more balanced.”

Insiders are not missing that warning call.

Is the world’s greatest investor buying or selling?

Warren Buffett has raised more cash than ever before. His Berkshire Hathaway fund held an astounding $325 billion after 3Q2024. That’s up from $167.6 billion at the start of the year. At about $300 billion, his equity holdings are now less than his cash position. In Q3 alone, Buffett sold 100 million shares of Apple (AAPL), cutting his holding by 25%.

Buffett famously sells high and buys low, which is the one principle that all investors should adhere to.

The writing is on the wall

The writing is on the wall for investors who care to step back and observe the big picture.

I foresee a market pullback starting in January. One sign will be the next earnings report from JP Morgan Chase, which is expected on Jan. 15 before the market opens.

Nobody can predict whether the pullback will be a crash like Black Monday, October 19, 1987, when the Dow 30 index plunged 22.6%, or the beginning of a meltdown. Nobody knows, but we should all be able to see the black clouds overhead today

Share this post