Yin Yang 🥷👇☯

Everyone who bought the tariff news yesterday after 1:35 PM is red. After the 2nd largest % Nasdaq gain ever!

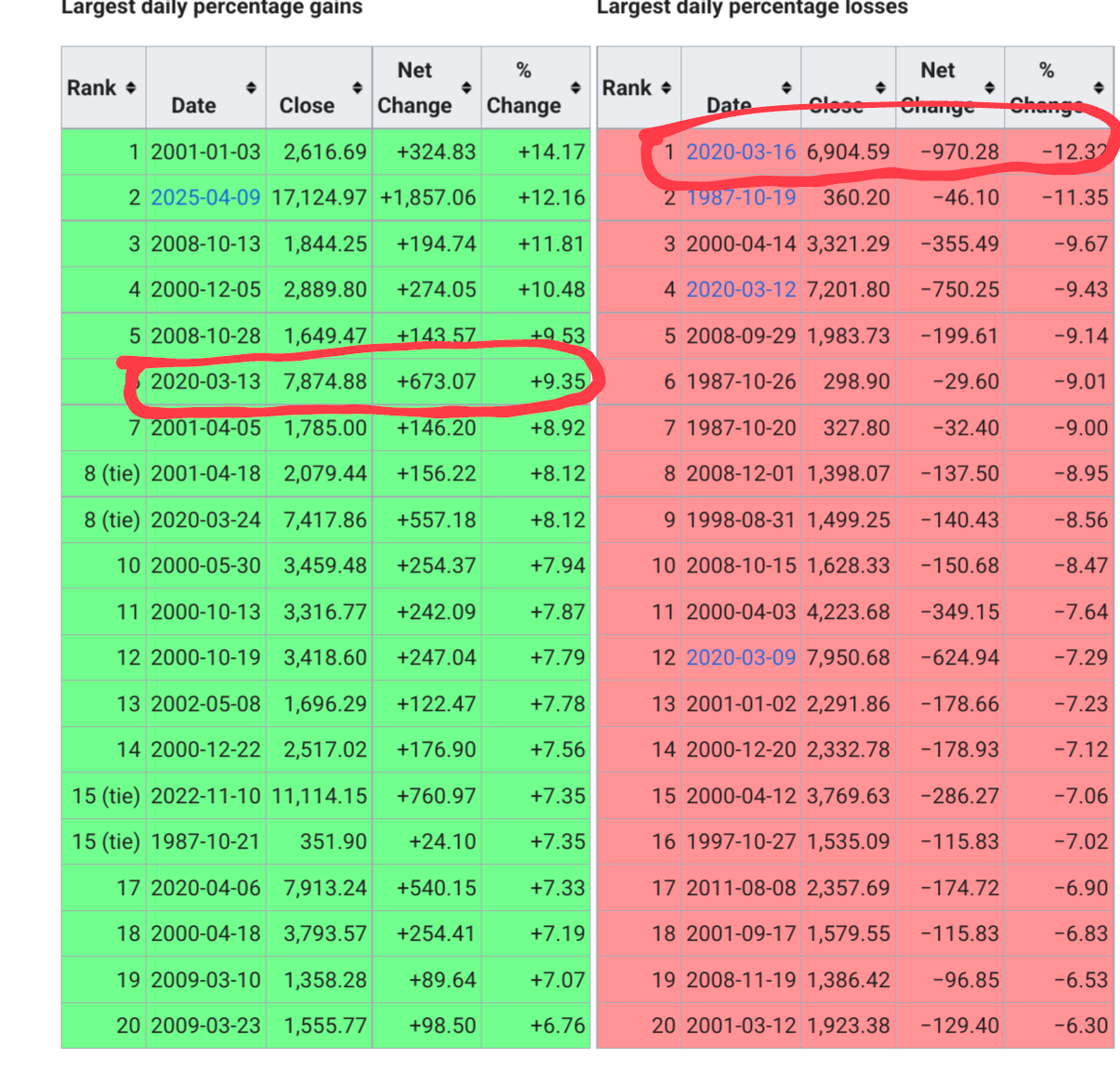

The largest face ripper rallies happen in bear markets. Yesterday was #2 face ripper in history. Does that mean we are in top 2 bear markets in history and most don’t realize?

At one point today, the Nasdaq was down 6.5% making it into top 20! Closed down 4%.

Look at the groupings of top % gainers vs % losers.

Yesterday’s podcast for those that missed it…

1:49 pm

“This is what the strongest bounce oomph looks like per my system. I don't trust it.”

2:43 pm

“If breadth doesn't improve don't be shocked by selling into close”

Close

If you want to learn this same system of applying a lie detector test on intraday action it is avail to paid subscribers.

What financial advisers are telling clients? Sound familiar? It's a script they all got in training.

Pop Quiz: what principle is glaringly missing in below adages?

*One key advantage of 401(k) plans is automatic, consistent investing, typically through payroll contributions. This strategy, known as dollar-cost averaging, allows you to buy more shares when prices are low during market downturns. To make the most of this, ensure your account is well-diversified.”

“Avoid the temptation to move your investments to cash during market drops, as this can lock in losses and cause you to miss out on the rebounds that have followed every historical downturn,”

“If you’ve got more than five years until you retire and especially more than 10 years, there is no reason to hit the panic button”

“Over the long haul, stocks have been the best performing asset class, and the ones most likely to outpace inflation.”

“The big overarching message is it’s very important not to get too wrapped up in the flavor of the week and to focus on the longer term,”

“We have told longer-term investors that they should be excited to see the market in a corrective period.”

“We get big moves down and then big moves up. If you look at the 20 best trading days over the past 50 years, half of them happened during big moves down in the market. Investors who sit on the sidelines risk missing crucial rebounds, leaving them worse off.”

ANSWER: The absence of selling rules and risk management. They want you in and always fully invested long. You are too dumb to sell. Only Wall St is sophisticated enough to take profits!

Free Preview: 18 min

Full Episode: 21 min

Please remember to ❤️

or the 🥷 will find you!

🎧 Podcast Available on all major platforms: Spotify | Apple | Amazon

👉 Recommended Chart Software at Slope Charts