Hardest hitting excerpts for me:

At Berkshire, we particularly favor the rare enterprise that can deploy additional capital at high returns in the future. Owning only one of these companies – and simply sitting tight – can deliver wealth almost beyond measure. Even heirs to such a holding can – ugh! – sometimes live a lifetime of leisure.

Berkshire’s ability to immediately respond to market seizures with both huge sums and certainty of performance may offer us an occasional large-scale opportunity.

There remain only a handful of companies in this country capable of truly moving the needle at Berkshire, and they have been endlessly picked over by us and by others. Some we can value; some we can’t. And, if we can, they have to be attractively priced. Outside the U.S., there are essentially no candidates that are meaningful options for capital deployment at Berkshire. All in all, we have no possibility of eye-popping performance.

Though the stock market is massively larger than it was in our early years, today’s active participants are neither more emotionally stable nor better taught than when I was in school. For whatever reasons, markets now exhibit far more casino-like behavior than they did when I was young.

The casino now resides in many homes and daily tempts the occupants. One fact of financial life should never be forgotten.

Wall Street – to use the term in its figurative sense – would like its customers to make money, but what truly causes its denizens’ juices to flow is feverish activity. At such times, whatever foolishness can be marketed will be vigorously marketed – not by everyone but always by someone.

Occasionally, the scene turns ugly. The politicians then become enraged; the most flagrant perpetrators of misdeeds slip away, rich and unpunished; and your friend next door becomes bewildered, poorer and sometimes vengeful. Money, he learns, has trumped morality.

One investment rule at Berkshire has not and will not change: Never risk permanent loss of capital. Thanks to the American tailwind and the power of compound interest, the arena in which we operate has been – and will be – rewarding if you make a couple of good decisions during a lifetime and avoid serious mistakes.

- Warren Buffett

Podcast Available on Spotify | Apple | Amazon

Follow me on Substack Notes

Premium Subscribers, keep scrolling for Show notes!

Financial Freedom is not free, but the treasure is worth the pursuit.

Lock in prices forever before inflation

Show support for the work

Substack featured twice

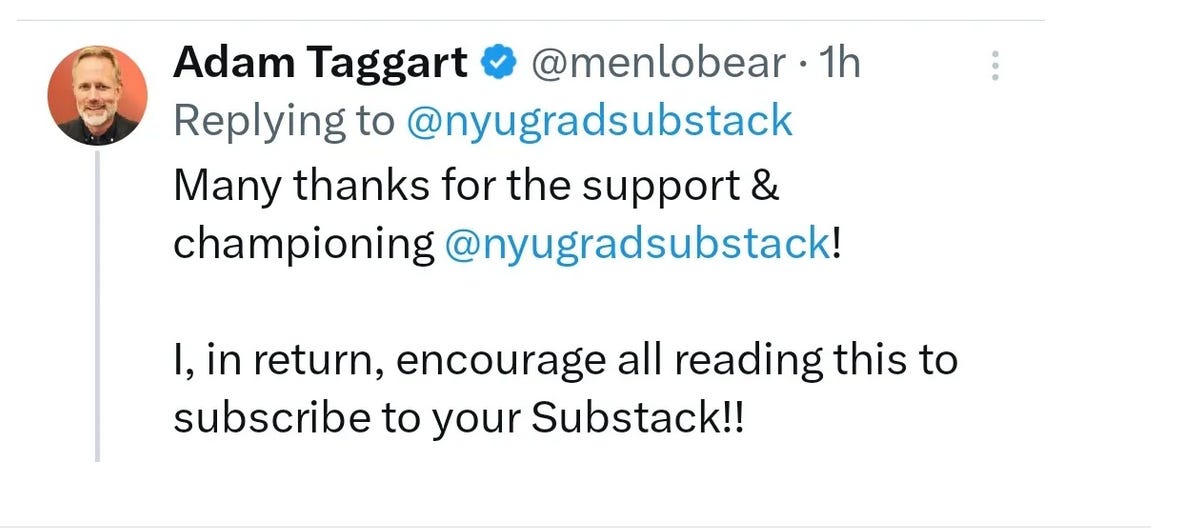

Recommended by

and many others

Our Subscribers range from executives at Fortune 100 companies, novice investors, financial professionals, to soon to be retirees

What will premium include?

(at minimum)

Over time you will develop ability to analyze the markets and become more comfortable making your own decisions and controlling your own wealth

Actionable Watchlist(s) and chart

Premium only content

Full podcast episodes & show notes

Here are a few links to popular archive content, giving you a flavor of what to expect:

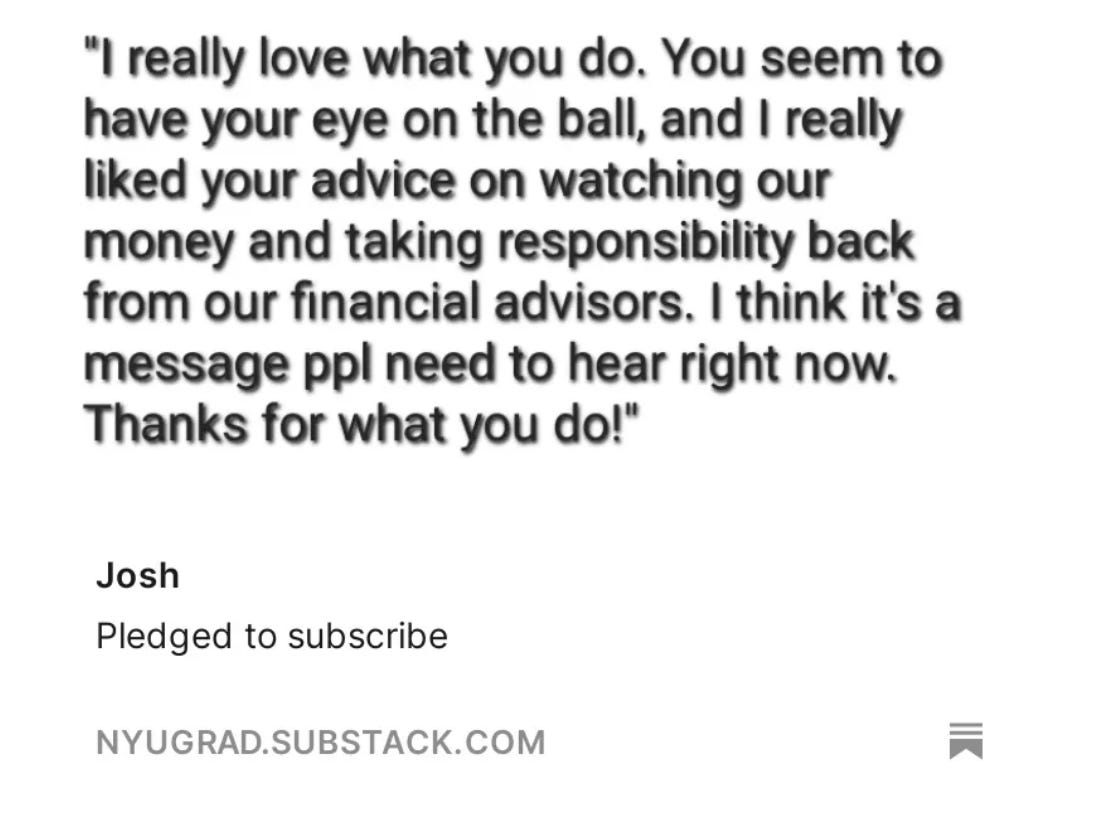

TESTIMONIALS

“Honesty in a sea of deception is of great value” - Ralph (Paying Subscriber)

“I like your in-depth analyses of the markets as well as pointing out what might lurk underneath that could rise up to bite us” - Sorell (Paying Subscriber)

“Your Wrap on the markets every day keeps me focused and grounded” - Lj (Paying Subscriber)

"I want to lean how to read the market for longer term trades as opposed to what Wall Street wants me to do” G.M (Paying Subscriber)

"I like your objective view on the markets” Ron P (Paying Subscriber)

"Good info. Succinct and relevant. Very good calls this month.” Andy J. (Paying Subscriber)